This story was first published in the Irish Mail on Sunday on 27/11/11

By: Michael O’Farrell

Investigations Editor

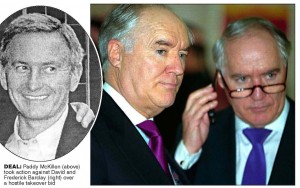

TWIN billionaire brothers – David and Frederick Barclay – have offered Anglo Irish Bank £130m (€152m) in cash to take over some of the debts owed to the bank by the developer Paddy McKillen. the Irish Mail on Sunday has learned.

The debts are secured against three of London’s most famous landmark hotels – Claridge’s, the Berkeley and the Connaught.

The offer would help Anglo – now rebranded the Irish Bank Resolution Corporation (IBRC) – to recover money on behalf of the taxpayer.

But the Barclay brothers, who own businesses such as the Ritz Hotel and the Daily Telegraph newspaper, have become frustrated at what they perceive as Anglo’s unwillingness to do the deal, according to insiders.

Their offer to buy McKillen’s debt was first made in writing to the IBRC on October 28.

It was followed by a number of communications and one face to face meeting since then.

It is understood that Anglo has raised the possibility of a bigger deal in which even more of McKillen’s debt would be sold – but sources say that although that possibility has been favourably received by the Barclay brothers, no specific details have yet been provided.

‘We would consider doing a bigger deal if it would make it easier for them,’ said a spokesman for the businessmen.

But in advance of an Anglo board meeting on Wednesday he stressed that the bank had to make a decision quickly – or face seeing its security diluted.

‘All we can do is tell them that the pressure on IBRC is to accept our offer now and get a full value for the Irish taxpayer,’ a spokesman said.

The Barclay brothers are making the offer because it would allow them to take over control of the three hotels.

They recently acquired control of over 64% of the hotels by purchasing the related debts of Derek Quinlan for €800m from Nama.

Mr McKillen, whose loans from Anglo are understood to run to hundreds of millions, owns the remaining 36% of the hotels. He won a landmark court action to prevent his loans being taken over by Nama because he was servicing them.

‘We have done the fair thing and offered the Irish taxpayer a very strong offer now or they can wait for the inevitable rights issue and what pressure will we be under ever to engage in a conversation with IBRC again?’ the spokesman said.

‘We have placed a value on the security that they hold and if they don’t take the offer then we are going to have a rights issue.

‘Then we won’t be making the offer to the Irish taxpayer because the company would have been refinanced by us,’ he continued. A rights issue – meaning the creation of new extra shares in order to raise more capital – has to be offered to existing shareholders first. The price at which such shares are offered is usually at a discount which gives shareholders an incentive to buy them.

But if an existing shareholder does not or cannot buy the new shares their overall stake in the company is diluted.

The move puts a cocked gun to Anglo’s head and if accepted could see Mr McKillen’s percentage stake in the prestigious hotels, which are currently controlled by the Maybourne Hotel Group, reduced.

Anglo will now have to decide whether it wants to continue supporting McKillen’s debts or cash in so as to see an immediate return for the taxpayer.

The matter has already been aired in court in London this week as Mr McKillen launched a case saying he had been oppressed as minority shareholder by the Barclay brothers’ launch of a hostile takeover bid.

Nama, too, is on the verge of being dragged into the case and has been named as a party by the London High Court.

But in the short term the £130m offer now on the table from the Barclay brothers will put the bank under immediate pressure to decide whether it wants to continue to bankroll McKillen’s shareholding, or recover a large chunk of his debts in the interest of the taxpayer.

ENDS

Here at NewsScoops we are always delighted when others follow up our scoops. Here’s how the Irish Times covered the story a week after we first broke it.

December 6, 2011

Barclay brothers move to take control of hotel group

SIMON CARSWELL Finance Correspondent

THE BARCLAY brothers, who control 64 per cent of the Maybourne Hotel Group in London, will this week propose injecting about £200 million (about €230 million) into the group in an attempt to wrest control from fellow investor Paddy McKillen.

The group behind the Claridge’s, Connaught and Berkeley hotels is at the centre of a tug of war between media tycoons the Barclays and Mr McKillen, a 36 per cent shareholder in the hotels.

David and Frederick Barclay, owners of the Daily Telegraph , will propose a rights issue at a board meeting this week to raise about £200 million from the shareholders.

This would force Mr McKillen to inject £72 million if he is to avoid his shareholding being diluted in a move which is interpreted as an attempt by the brothers to take control of the group.

The brothers have recently made a proposal to Irish Bank Resolution Corporation, formerly Anglo Irish Bank, to buy £130 million of debt secured on Mr McKillen’s shareholding.

The Barclays have presented their proposal to the bank as a means of reducing the State’s loan book, as the bank is being wound down.

IBRC is resisting the overture because the loans owing on Mr McKillen’s shares represent only part of its commercial relationship with him.

The High Court was told during Mr McKillen’s legal action with the National Asset Management Agency last year that he had loans and connected borrowings totalling €800 million with Anglo.

A spokesman for the Barclays had no comment on their plans.

A spokeswoman for Mr McKillen queried whether they could seek cash from shareholders. “We would question their right to a single seat on the board, let alone to propose a rights issue,” she said.

Mr McKillen has taken legal proceedings against the brothers in London High Court, claiming oppression of his minority rights, in a case to be heard in March.

The brothers have taken majority control of the group by purchasing the bank debt secured on the 35.5 per cent shareholding held by investor Derek Quinlan.

They have also bought a Cypriot firm, which held a 25 per cent stake owned by the family of Manchester businessman Peter Green and a 3 per cent stake held by stockbroker Kyran McLaughlin.

They borrowed from UK bank Barclays to buy €800 million debt on the group from Nama.

Mr McKillen raised his stake several years ago through a cash call on shareholders, leapfrogging Mr Quinlan on the share register to become the biggest shareholder.