This article was first published in the Irish Mail on Sunday on November 20, 2011.

By: Michael O’Farrell

Investigations Editor

HE IS Nama’s largest client with debts of close to €3bn but the Irish Mail on Sunday can reveal that developer Joe O’Reilly still retains a lifestyle of extraordinary opulence at his luxury Dublin home.

Mr O’Reilly – who has negotiated a salary of €200,000 from Nama in addition to the state picking up a large portion of his debts and supporting the survival of his business – lives in Cnocard, a sprawling multi-million euro mansion in Foxrock.

The indebted developer’s negotiations with Nama ensure that he is in no danger of losing the extravagant house.

Internet satellite images reveal such amenities as a back garden tennis court, a putting green and a sand bunker amid half a hectare of manicured lawns overlooked by decking and terraces.

But now for the first time, an MoS investigation can bring you inside the vast interior of the salubrious home, revealing every detail of the luxurious comforts enjoyed by Nama’s most indebted developer.

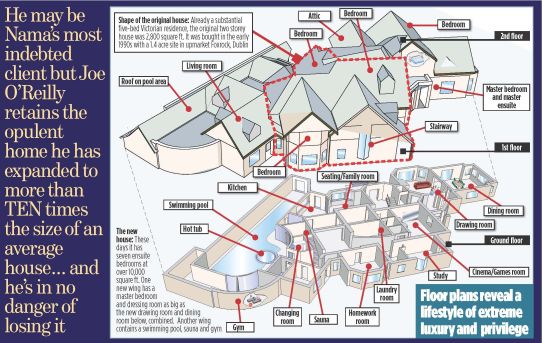

Those comforts – outlined in plans which were given the go-ahead by Dun Laoghaire Rathdown Council in 2004 – include a 20m indoor swimming pool, a private gym, a cinema/games room, a hot tub and sauna and an assortment of recreation and living rooms extending to three floors.

The average size of homes in Ireland is 947 square feet. In contrast the seven bedroom O’Reilly home extends to 10,150 square feet – more than ten times the size of most houses.

When his loans were first taken into Nama Mr O’Reilly and his related companies owed Anglo Irish Bank €1.8bn. More than €1bn is owed to other banks, primarily to AIB.

A Fianna Fáil supporter and donor, Mr O’Reilly is best known for the development of the Dundrum Town Centre. Famously he was also one of the Anglo Golden Circle who agreed to borrow money from the bank to bail out a catastrophically bad share deal by Seán Quinn – a matter still being investigated by gardaí, the director of corporate enforcement o e ll he nt and the financial regulator.

He was also one of the largest housing developers in the State through his companies Chartered Land and Castlethorn Construction.

During the housing boom in the 1990s Mr O’Reilly’s construction business began to grow rapidly after he bought and developed a €7.5m site at the former Carysfort College near Blackrock in Dublin.

It was during this period that he acquired his current Foxrock home.

At the time the property, although a respectable five-bed Victorian residence, was a much more modest affair than it has become today.

Its transformation since then has mirrored the success of the Celtic Tiger as Mr O’Reilly and his wife Deirdre continually upgraded and extended the property as their speculative wealth and bank borrowings spiralled.

The O’Reillys applied for permission for the first of what would become many extensions in 1993. But the first extension was modest compared with what was to come, adding just a single storey wing to the side of the home to allow for a new family sun room and more living space on the ground floor. The following year the garage was moved and a new gate and drive were installed.

Then in 2001/2002 a new two-storey side and rear extension was applied for. Plans featured a gym, walk-in wardrobes and a playroom.

In January 2003 permission was granted for another two-storey side extension as well as a ‘two storey plus dormer rear extension’ which featured a steam room as part of the master bedroom ensuite.

But even as these new wings were being built in 2004 the O’Reillys applied to alter the plans mid-construction and they added some distinctly Celtic Tiger accessories.

And for the first time Mr O’Reilly, fd who had always used his name on planning applications, was replaced by his wife who used her maiden name – Deirdre Traynor – on the application.

The plans submitted by Mrs O’Reilly – and subsequently built by the family – are nothing short of breathtaking.

Indeed such is the scale of the property that it clearly cannot be managed by the family alone. And so provision for staff accommodation is included alongside thousands of square feet of living and recreation space.

The bespoke kitchen overlooks a 20m indoor pool alongside which is a private sauna and hot tub. At the foot of the pool is a complete gym beside male and female changing rooms and showers.

Beyond that the ground floor consists of several family and drawing rooms as well as an office, a children’s den, a cinema/games room and a room described as ‘playroom/homework.’ Upstairs all seven bedrooms are en suite while behind the home a sunken terrace overlooks the back garden golf and tennis facilities.

Later that year yet another planning application added a dormer double garage and storeroom which at almost 700 square feet would be considered a good-sized apartment.

Unlike the tens of thousands of families who face losing their homes because they cannot pay their mortgages, Mr O’Reilly does not have to fear losing his home even though his debts are astronomical. That’s because he has negotiated a deal with Nama which allows him to remain in his own home and earn a tax payer-funded salary of €200,000 in return for helping the agency to manage his ongoing property developments.

His company’s income from the state has not ended there. Despite the downturn in property in 2008 Fingal County Council bought a site for two schools for more than half a million euro per acre. The council had rezoned the land in 2007, multiplying its value, but went ahead with the price last year despite the recession.

The sum was paid to Mr O’Reilly’s Castlethorn Construction.

At the time then opposition TD Joan Burton was scathing about what she called a ‘sweetheart deal’.

‘It simply beggars belief that boom-time prices are being handed over to Nama developers for school sites at a time when property prices are on the floor,’ she said. ‘€7m for a school site is a king’s ransom.’ ‘This sweetheart deal for a Namabound developer in the dying days of a Fianna Fáil government stinks to high heaven. Spending €7m on acquiring the Kellystown site means that less money is available for the construction of the muchneeded permanent building for Luttrelstown Community College.’ But the story of Nama’s ‘crackdown’ on developers continues. The other Nama client receiving a €200,000 salary from the state’s asset management company is Sean Mulryan who lives in a similarly plush home – complete with pool, Jacuzzi and hot tub – as revealed by the MoS two weeks ago.

Mr O’Reilly emerged with his Nama deal even though he was one of the developers who initially sought to put the family home and other properties out of reach of Nama by transferring them to his wife.

As revealed first in the MoS the Foxrock home was transferred out of Mr O’Reilly’s name and into that of his wife on March 5, 2009 – just months before the establishment of Nama.

Then, in the summer of 2010, Mr O’Reilly was snapped by the MoS enjoying a sun-kissed break in the exclusive Monte da Quinta resort in the Algarve. Mr O’Reilly owns a villa in the resort although a loan on the property has now been taken over by Nama.

Just days after he was photographed by the MoS relaxing and lounging by the pool in the 35 degree Algarve heat, Nama boss Frank Daly promised that his agency would not go soft on developers.

‘The banks have displayed what I can only describe as remarkable generosity towards some of their borrowers,’ he said adding that bankers were ‘probably sentimentally or emotionally attached to some borrowers.’ A year later it emerged that Nama had agreed to pay Mr O’Reilly his €200,000 salary and that a profit sharing arrangement had also been reached which could see the indebted developer earn commission on any targets he exceeds.

ENDS

Here at NewsScoops we are always delighted to see others follow our example. In the instance below the Evening Herald puts its own spin on our article six days after we first went to press.

By Conor Feehan

Saturday November 26 2011

THE resident of this luxury mansion has bank debts of €2.8bn but is paid €200,000 a year by NAMA.

Prominent politicians and businessmen have branded developer Joe O’Reilly’s position “an absolute outrage” and said “it is no wonder Germany are disgusted with us”.

Mr O’Reilly, who developed the Dundrum Town Centre, is NAMA’s largest client with debts of €2.8bn.

Yet it is paying him his huge salary with taxpayers’ money while allowing him to live in his seven-bed Foxrock mansion complete with indoor swimming pool, sauna, gym, tennis court and golfing facilities.

Today, People Before Profit’s Richard Boyd Barrett described the decision as “an absolute outrage that is beyond words”.

And veteran businessman Ben Dunne said NAMA was “rubbing our noses in it” when it comes to the treatment some developers.

“People who helped to bankrupt the country are being paid with taxpayer’s money while others are being slaughtered by austerity cuts,” said Mr Boyd Barrett.

“It beggars belief. The poor and the vulnerable are being pushed over the edge by this,” he added.

“This developer has loans he cannot repay to the banks, so the taxpayer has to stump-up and then pay their salary too while suffering cut after cut themselves.”

Mr O’Reilly was also one of the Anglo Golden Circle of 10 who agreed to borrow money from the bank to buy up shares being offloaded by the now bankrupt businessman Sean Quinn.

That matter is still under investigation by gardai, the director of corporate enforcement and the financial regulator.

Mr O’Reilly was also one of the largest housing developers in the State through his companies Chartered Land and Castlethorn Construction.

He bought his Foxrock home during the housing boom in the mid-90s. It was a more modest five-bed Victorian residence at the time, but an ambitious list of extensions have transformed it into a luxury mansion. And Mr O’Reilly’s negotiations with NAMA ensure that he is in no danger of losing the house.

In the back garden, amenities include a tennis court, a putting green and a sand bunker on half a hectare of lawns overlooked by decking and terraces.

Plans approved by Dun Laoghaire Rathdown Council in 2004 for the property include a 20m indoor swimming pool, a private gym, a cinema/games room, a hot tub and sauna and an assortment of recreation and living rooms extending to three floors.

When his loans were first taken into NAMA, O’Reilly and his related companies owed Anglo Irish Bank €1.8bn. More than €1bn is owed to other banks, mostly to AIB.

“I don’t know if NAMA are worse or Joe O’Reilly is worse, they’re both as bad as each other,” businessman Mr Dunne told the Herald.

“Joe O’Reilly has as much chance of living in that house on that money as the man on the moon.

“It’s no wonder the Germans are disgusted with us. He’s rubbing our noses in it,” Mr Dunne added.

Mr O’Reilly’s deal with NAMA allows him to remain in his own home and earn a tax payer-funded salary of €200,000 in return for helping to manage his ongoing developments