A version of this story was first published in the Irish Mail On Sunday on 13/11/2011

By: Michael O’Farrell

Investigations Editor

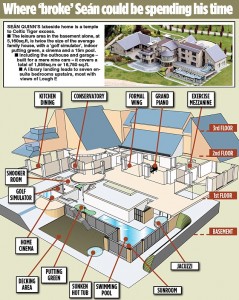

AN INDOOR golf simulator, a putting green overlooking a 15 metre swimming pool, a sunken hot tub, a Jacuzzi pool, a cinema and a snooker room – welcome to the bankrupt world of Seán Quinn.

He declared himself penniless on Friday but the controversial Cavan businessman who owes Anglo Irish Bank €2.8bn will still be entitled to live in his family home, which cannot be seized. And few bankrupts can claim a family home as impressive as Mr Quinn’s 14,700 square foot mansion beside the Quinn Group’s Slieve Russell Hotel in Ballyconnell, Co. Cavan.

During bankruptcy proceedings, all assets – bar the family home – are collated and put under the control of a court-appointed bankruptcy official. This means that Anglo Irish Bank will not be able to seize the Quinn home despite the mind-boggling amounts of money it is owed by the family.

Quinn’s move on Friday was an 11th hour action prompted by a belief that the bank would attempt to force him into bankruptcy south of the border tomorrow. In the Republic of Ireland, he would have faced 12 years of penury overseen by the courts, but a few miles across the border from his Cavan home he can work through the process in just one year.

And Quinn’s own home may now become involved in the row. In court Quinn’s lawyer claimed that the family home in fact belongs to his children, and that he had no assets and a pension worth just €10,000. But Land Registry documents show the house was only ever registered in the name of Mr Quinn and his wife, implying that some sort of private transfer of ownership may have happened since, with paperwork lodged in public registry.

There have been other transfers of assets by the Quinn family, who were recently accused in court by Anglo of engaging in a ‘conspiracy’ to hide and redistribute their assets. His children and sons-in-laws are already facing criminal investigation in Sweden for allegedly putting assets out of the reach of Anglo Irish Bank.

As revealed by this paper last month, the bank lodged formal complaints to the Company Registrations Office in Stockholm, claiming the Quinns had illegally transferred properties worth hundreds of millions out of its reach.

The complaints were made under Chapter 11 of the Swedish Criminal Code, which carries prison sentences of up to six years.

Regardless of who owns the many assets and properties in the wider Quinn empire, public docu-ments appear to place ownership of the family mansion squarely in the hands of Mr Quinn and his wife.

Planning permission and land registry documents show that the home was registered in the names of Seán and Patricia in June 2004 and was completed in 2006. At the time of construction, Mr Quinn was still considered the richest man in Ireland – something that is clearly reflected in the plans.

‘Seán Quinn is a well-known businessman in the Cavan area,’ reads the application by architect Paul Joyce. ‘This present application seeks to demolish their existing house and replace it with a new family house which is more fitting to their needs.’ Those needs included seven en-suite bedrooms and a luxurious leisure area.

Overlooking the pool area is an exercise mezzanine, where Mr Quinn liked to work out in the morning while watching business TV news channels. The home also boasts its own bar, a grand piano, a library, a lift, a built-in dog house, balconies and a large deck overlooking Lough Aghavoher. Outside, at the end of a covered walkway, is a nine-car garage.

It is likely that Anglo will challenge the validity of Mr Quinn’s Belfast bankruptcy since it will allow him to emerge clear of debts in just 12 months – even though the legal cases he is involved in will continue much longer than that.

In a statement, Anglo, now rebranded the Irish Bank Resolution Corporation, said it was ‘examining the validity of this application for bankruptcy in light of Mr Quinn’s residency and extensive business interests and liabilities within the state.’ Mr Quinn will have to satisfy the UK authorities regarding having lived and conducted business in Northern Ireland.

Steve Thatcher, a British insolvency expert with Irish Bankruptcy UK, said that all Mr Quinn had to do to qualify was live in Northern Ireland for a few months.

‘It doesn’t say under any case law how long that must be but you have to be in the area for at least three months. So he could have lived in Northern Ireland for as little as four months,’ he told the MoS.

Mr Thatcher, who is currently advising many Irish people considering bankruptcy in the UK, said Anglo would likely have difficulty contesting this.

Although his family home has always been in Cavan, Mr Quinn has had businesses and properties on both sides of the border.

Mr Thatcher said that Mr Quinn will likely be able to negotiate his residency arrangements with the official receiver and may be allowed to live in his Cavan home during his bankruptcy period.

But even if he is forced to remain in Northern Ireland, he can return for good after 12 months and travel to visit his wife across the border as long as he informs the bankruptcy receiver.

In a lengthy statement, Mr Quinn said he had been born, reared and worked all his life across the border in Fermanagh. ‘I have done absolutely everything in my power to avoid taking this drastic decision.

The vast majority of debt that Anglo maintains is owed is strenuously disputed,’ he said.

‘However, I cannot now pay those loans which are due, following Anglo taking control of the Quinn Group of companies, which I and a loyal team spent a lifetime building.

I find myself left with no other alternative.’ Mr Quinn also accepted some of the blame for his downfall. But he accused Anglo of self-interest, lack of responsibility and bad lending.

‘I am not in the business of pointing fingers or making excuses,’ he said. ‘However, recent history has shown that I, like thousands of others in Ireland, incorrectly relied upon the persons who guided Anglo and who wrongfully sought to portray a “blue chip” Irish banking sector.

‘Anglo is now tirelessly working with its PR advisers to tell a different story of how I supposedly brought down the Quinn Group. This is wrong,’ he said.