By: Michael O’Farrell

Investigations Editor

THE boss of a disability group racked up €2,328 on a charity credit card in a single day’s shopping in New York.

Barbara O’Connell’s personal spending using her Acquired Brain Injury Ireland credit card included more than €760 at Macy’s department store and almost €210 at Abercrombie & Fitch on October 19, 2009.

Though the money is understood to have been later paid back, the use of the charity credit for personal purchases is strictly forbidden by ABI Ireland’s rules and came eight months after the Government had passed legislation to cut the wages of all public servants in a bid to rescue the economy.

An ongoing Irish Mail on Sunday investigation into the charity – which receives €10m of its €12m annual budget from the taxpayer-funded HSE – can also reveal that Mrs O’Connell used charity funds to buy a €900 painting for her husband after he stepped down as the charity’s chairman.

The board of ABI Ireland enjoyed Christmas gift vouchers and wine worth thousands of euro paid for from charity funds.

A one-week study trip to the US by Mrs O’Connell cost ABI Ireland €7,000.

Established in 2000, ABI Ireland provides services to over 1,200 HSE clients who live with an acquired brain injury.

More than 80% of its annual budget comes from public funds.

The €2,328 spend in New York on Mrs O’Connell’s ABI Ireland credit card is strictly forbidden by the charity’s rules.

Those rules state: ‘The card is not to be used for expenses as the organisation has a vouched expense system in place. The card is not to be used for personal use.’

In addition to the New York expenditure, other unauthorised personal expenditure involved purchases at Ticketmaster.

The MoS asked Mrs O’Connell whether or not there are any outstanding amounts of personal expenditure which have yet to be refunded to ABI Ireland.

We did not receive a reply.

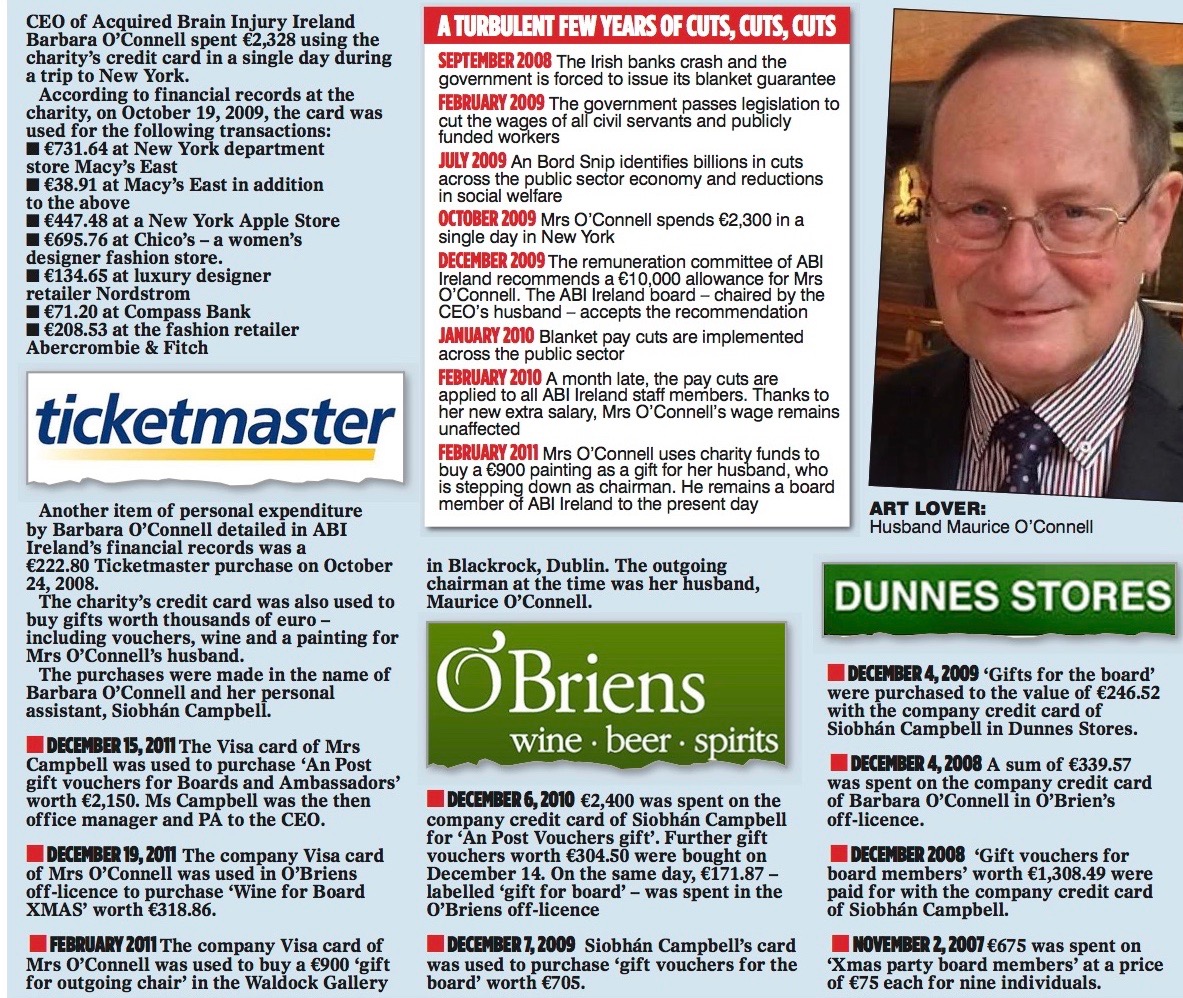

The use of charity funds to purchase a painting for Mrs O’Connell’s husband, Maurice, came after he stepped down after seven years as chairman of ABI Ireland in February 2011.

Though he is no longer chairman, Mr O’Connell remains on the charity’s board to this day – something staff feel makes it difficult to raise issues related to the CEO, Mrs O’Connell.

The painting was gifted to Mr O’Connell just months after the pay of staff at the charity was cut as part of the Government’s public service pay cutbacks.

The MoS revealed last week that Mrs O’Connell had avoided the pay cuts thanks to a €10,000 top-up allowance to her salary.

The Christmas gift vouchers and wine worth thousands of euro paid for with charitable funds also raises serious questions about spending at the organisation. On December 15, 2011, the Visacard issued to Mrs O’Connell’s personal assistant was used to purchase ‘An Post gift vouchers for Boards and Ambassadors’ worth €2,150.

Then on December 19, 2011, the Visacard issued to Mrs O’Connell was used in O’Brien’s off-licence to purchase ‘Wine for Board XMAS’ worth €318.86.

The MoS asked Mrs O’Connell, who sits on the board of the Charities Regulatory Authority, if she felt that this spending on gifts is appropriate expenditure for a charitable organisation that receives more than 80% of its funds from the taxpayer. We received no reply.

Further records show that a study trip undertaken by Mrs O’Connell to America in 2012 cost the charity almost €s 7,000.

This figure includes a €3,981 fee to Harvard Business School for a course in ‘Non-Profit Strategic Management’. Mrs O’Connell undertook a further Harvard course entitled ‘Strategic Decision Making’ in 2013.

The MoS asked Mrs O’Connell how the courses had benefited ABI Ireland and whether cheaper alternatives had been sourced. We received no reply.

Mrs O’Connell In response to detailed written questions about the above expenditure, ABI Ireland chairman Diarmaid Ó Corrbuí issued a short statement to say that the board is ‘satisfied that there are appropriate records and explanations available in each case’.

‘Mrs O’Connell retains the full confidence of the board,’ he said. Public Accounts Committee chairman, Seán Fleming, has promised to add the granting of Mrs O’Connell’s €10,000 allowance to the Committee’s ongoing investigation of the controversial €1.6m in secret payouts to managers at the St John of God group first exposed by the MoS in June.

Meanwhile, the HSE is ‘involved in an ongoing financial review’ of ABI Ireland which is ‘paying particular attention… to the management/admin and back office supports of the organisation’.

The review comes at a time when the charity is carrying a deficit of more than €1m and as a number of staff have taken voluntary redundancy.

Payroll data provided to the MoS by a whistleblower shows that Mrs O’Connell’s salary in 2009 was €116,541 – the equivalent pay of a top-of-the-scale HSE Local Health Office Manager.

Because of the level of State funding it receives, ABI Ireland follows HSE pay grades and complies with public-sector pay scales.

This meant Mrs O’Connell was facing a €10,000 drop in her salary when, in February 2009, the Government passed legislation to reduce all public-sector wages. The cut would have taken effect the following year.

However, in December 2009, just weeks before the pay cuts were about to take effect, the remuneration committee and board of ABI Ireland agreed the new €10,000 allowance for Mrs O’Connell. They agreed to backdate it to July 2009.

While her husband was chairman of the charity at the time he was not on the remuneration committee and did not participate in the decision to award his wife the money.

Mrs O’Connell told the MoS last week that the allowance was not a top-up but a payment sanctioned to compensate her for her role with the Anvers Housing Association, a social housing body that comes under ABI Ireland’s auspices.

Anvers has always been based at and administered from ABI Ireland’s headquarters by various staff members including Mrs O’Connell.

However, the net effect of the board decision was that instead of dropping in line with all other staff salaries, Mrs O’Connell’s gross pay packet was completely unaffected by the Government pay cuts that took effect in January 2010.

In fact her pay packet increased slightly to €117,387, a rise of more than €800. At the same time, Mrs O’Connell repeatedly assured charity staff that she was being paid according to HSE pay scales and that no top-ups were being paid at ABI Ireland.

The MoS has also established that ABI Ireland makes a 10% of salary contribution to the pension of Mrs O’Connell – while all other employees receive a 5% contribution.

In addition a backdated payment – that was not afforded to any other member of staff – was made to Mrs O’Connell’s pension. Information provided by a whistleblower also shows that ABI Ireland made backdated pension contributions worth €10,228 to Mrs O’Connell’s pension scheme in April 2004.

Asked about the pension payment last week ABI Ireland said it would be ‘absolutely wrong’ to refer to it as a ‘top up’ since Mrs O’Connell had been appointed in 2002 with a pension entitlement as part of her salary.

The charity said: ‘In 2004, it emerged that no pension contributions had been paid to the CEO’s pension fund. This was corrected with the payment of a lump sum pension contribution backdated to the CEO’s start date of 1 July 2002.’

The MoS then asked Mrs O’Connell why no other employees – none of whom received pension benefits until 2004 – had their pension backdated in this fashion.

In response Mrs O’Connell said: ‘At the time you refer to, a number of employees had opted not to participate,’ in the pension scheme.

Among the documentary information provided by a whistleblower is a letter dated February 20, 2004, which informed all staff that the pension scheme was coming into effect on March 1, 2004.

This means that no employees could have opted to participate in the pension scheme, as referred to by Mrs O’Connell, since it did not exist at the time.

Mrs O’Connell is also vice-chairwoman of the Disability Federation of Ireland.

investigations@newsscoops.org