By Michael O’Farrell

Investigations Editor

THE signature of a former chairman of a €200m social housing charity in receipt of millions in State funding was forged for four years after he left the organisation, an Irish Mail on Sunday investigation can reveal.

A fake signature was also used to open a new bank account for the Cooperative Housing Ireland charity.

The organisation also appears to have routinely paid out funds using blank cheques signed in advance by another chairman – a practice that eliminated a crucial corporate governance control. The revelations will raise questions for the coalition as it heads into an election in which social housing and homelessness are significant issues.

In recent months, Cooperative Housing Ireland – known until recently as the National Association of Building Cooperatives or Nabco – has become central to Government plans to alleviate the social housing crisis.

This has seen the organisation partner with Nama in the development of ghost estates for social housing purposes.

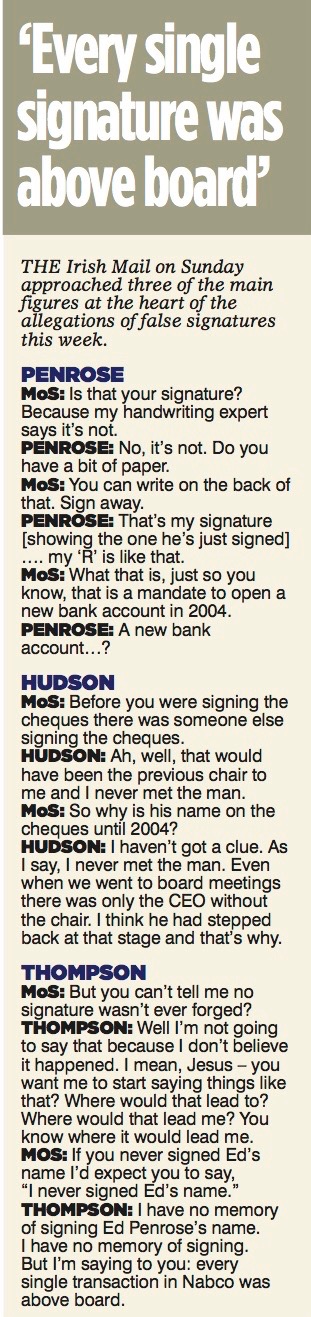

The signature that was forged for four years from 2000 to 2004 purports to be that of former Nabco chairman Ed Penrose.

When approached by the MoS, Mr Penrose confirmed that he had not signed any cheques or bank mandates for Nabco since leaving in 2000. He also viewed the signatures purporting to be his and confirmed that they were not genuine.

‘This is very serious for me because I’m a peace commissioner,’ he said.

There is no indication or allegation relating to any impropriety involving the charity’s funds.

But in 2011, allegations about the false signatures were reported to gardaí, the Revenue Commissioners, then-health minister James Reilly and a number of Opposition TDs by a concerned whistleblower.

Despite this disclosure, it appears that no formal State-level investigation ensued.

Instead, Cooperative Housing Ireland carried out a confidential ‘independent review’ in 2013.

But that review never established that forgery had taken place. Also Mr Penrose, whose forged signature was not only used on cheques but also on documentation to open a new bank account – was never told of the review.

He never knew his name had been misused until informed by the MoS as part of our investigation.

Annual accounts filed with the Register of Friendly Societies confirm that Mr Penrose left the Nabco board in 2000.

Since 1990 he had been one of two designated signatories – together with chief executive Bernard Thompson – to a Bank of Ireland account in St Stephen’s Green.

When he left, Mr Penrose’s name was not removed as a signatory as it should have been. Instead, someone appears to have forged his name on all cheques issued from that account from 2000 until late 2004.

At the time, all Nabco’s outgoings – more than €4m in 2003 – were paid entirely by cheque.

In 2004, years after Mr Penrose had left, a forgery of his signature was again used by Nabco without his knowledge to open a second Bank of Ireland account.

In written correspondence to the bank about the new account, Mr Thompson confirmed the ‘signatories are that of the existing account’.

The bank requested updated signatories on the original account and a few days later a new mandate to cover both accounts was provided by Nabco. It contained the signature of Mr Thompson and once again another signature purporting to be Mr Penrose.

The MoS showed the mandate to Mr Penrose, who again confirmed that it was false. A forensic handwriting analysis commissioned by the MoS also confirmed that the signatures were not genuine.

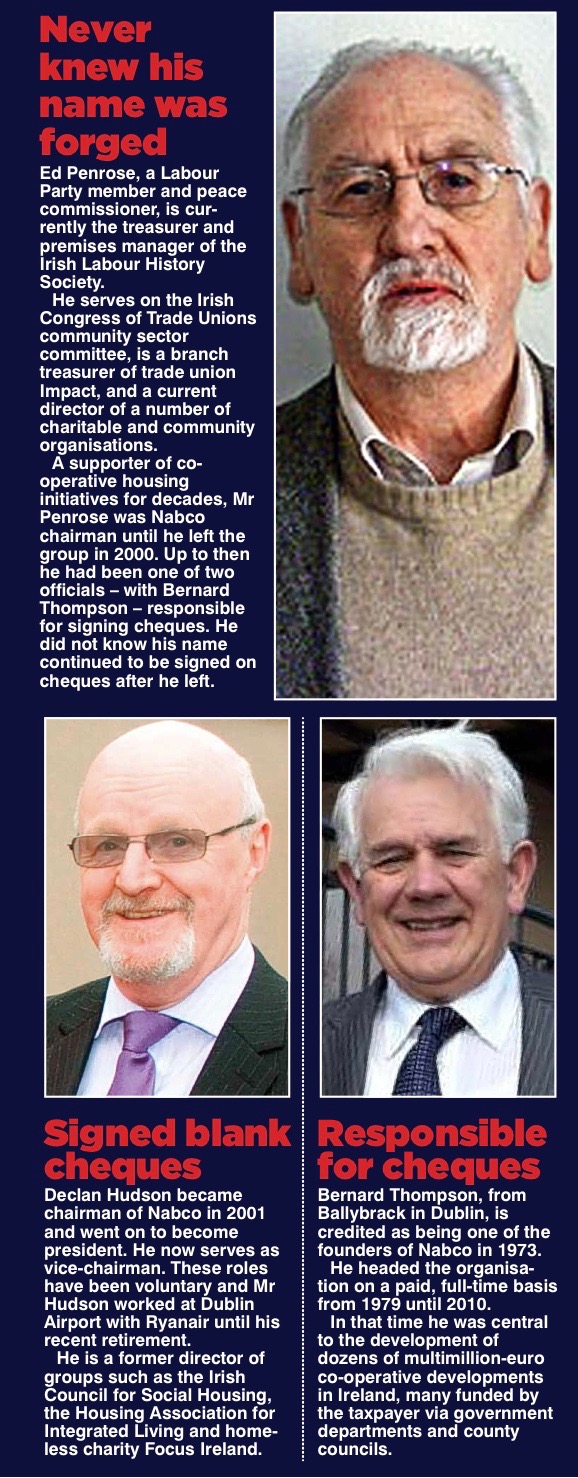

Denis Sexton, a graphologist and document examiner, said: ‘In my professional opinion, none of the signatures purporting to be that of Mr Penrose on these cheques is from the hand of Mr Penrose.’ When the MoS raised the issue of forged signatures with Mr Thompson, he said: ‘Well I certainly have no recollection of doing that. I mean I wouldn’t be doing that.

‘I have no memory of signing Ed Penrose’s name. I have no memory of signing. But I’m saying to you every single transaction in Nabco was above board.’ Mr Thompson, who retired in 2010 after almost 40 years at Nabco, said: ‘There is nothing wrong with the financial transactions. People were properly paid. What was paid for was obtained. Nobody benefited.

‘I can say that because I know that’s the truth.’ When pushed, Mr Thompson said he would be prepared to admit forging the signatures – though any such signatures may have been copied with no sinister intent – if it would help Nabco.

‘I’ll freely admit to anything to keep the organisation going. There’s an awful lot of people depending on it,’ he said.

But he also said he could not admit such a thing because it would lead to a police investigation.

The MoS also approached Nabco executive Declan Hudson who acted as chairman from 2001 to 2013.

Mr Hudson, who is currently vice chairman, took over as second signatory in late 2004 and is alleged by the whistleblower to have routinely signed entire blank cheque books which were then left for Mr Thompson to countersign to issue payments. Copies of entire cheque books of numerically sequenced blank cheques back up this allegation.

But when asked if he engaged in this practice, Mr Hudson declined to comment. ‘Well I’m not going to say anything. All right… I am not going to make any comment.’ When told that there was ample evidence of entire blank cheque books signed, Mr Hudson said: ‘I’ll wait until you show them to whoever you’re going to show them to and we’ll see what the legal people are going to do with this because I have no choice in this.’ Nabco is a registered charity now known as Cooperative Housing Ireland since November. It builds and runs cooperative housing projects around the country and is paid by the taxpayer to provide and manage affordable rent-based social housing for those in need.

In 2014 it was in receipt of financial assistance worth €144m from local authorities and received additional grants from a number of Government departments. It held cash reserves of €13m that year.

It holds and manages property assets worth €196m and pays its current CEO, former Irish League of Credit Union boss Kieron Brennan, a salary of €120,000.

A Cooperative Housing Ireland spokesman said it was aware of the historic allegations of ‘alleged forgery’ and that the recommendations of ‘an independent review’ in 2013 had been implemented.

He also said: ‘The organisation has undertaken a systematic reform of its governance arrangements and procedures and the area remains under review. The Revenue Commissioners have not undertaken an investigation into allegations regarding Nabco.’ When the MoS asked James Reilly what he had done with the information provided to him by the whistleblower, his spokesman said that his then-parliamentary assistant Tom O’Leary had assessed the material and advised that the Revenue had been asked to involve the gardaí by the whistleblower and that it would therefore be inappropriate for Dr Reilly to engage further with the whistleblower.