By: Michael O’Farrell

Investigations Editor

IRELAND’S largest nursing home company, with 1,200 residents, has moved its accounts offshore as part of a scheme designed to give millions to the wives and children of two Nama developers.

And in an embarrassment to Nama, an Irish Mail on Sunday investigation has revealed: A web of companies guarantees the two men’s wives the first €2m paid out in dividends from their ownership of Mowlam Healthcare each year, with the rest going to their children.

One of the two developers, John Shee, has absconded after arrest warrants were issued regarding a €24m Nama debt.

The accounts of Mowlam Healthcare – which had income of over €30m in 2011 – have been moved offshore to the British Virgin Islands (BVI) making them secret.

The nursing home firm has changed its articles of association, allowing it to give assets away for free if it wishes.

Mowlam Healthcare was set up by partners John Shee and Joe Hanrahan. Mr Shee is believed to have absconded to France.

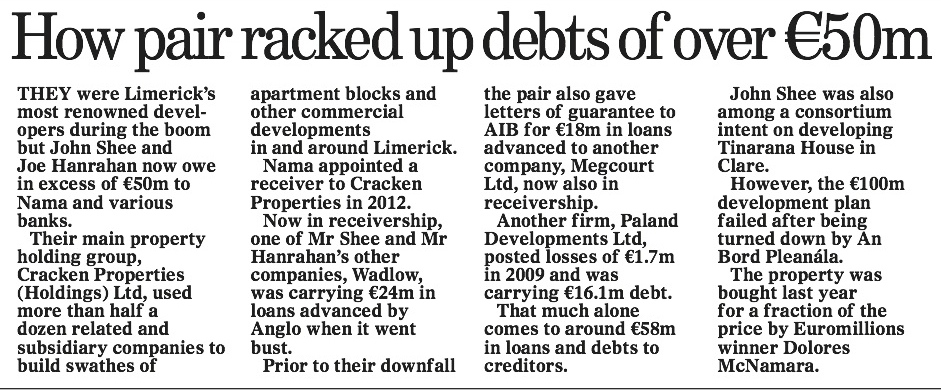

Together, the developers’ failed construction firms owe more than €50m to Nama and a series of banks.

The accounts of the nursing home group they established, Mowlam Healthcare, are no longer public since the company has re-registered as unlimited. However, the latest publicly available accounts for 2011 showed pre-tax profits of €2.5m on a turnover of €35m.

Much of Mowlam Healthcare’s income is funded by the taxpayer through the Fair Deal nursing homes support scheme.

The detail of Mowlam Healthcare’s offshore scheme – and the way in which it guarantees millions to Mr Shee’s and Mr Hanrahan’s wives and children – is revealed for the first time today.

Both developers gave personal guarantees to Anglo Irish Bank, AIB and Bank of Scotland when they secured construction loans in the years leading up to 2011.

In theory, the banks and Nama should have been able to seize assets such as the developer’s stake in Mowlam, which owns 23 nursing homes in 14 counties. However, details of that income are now hidden behind a web of companies which comes to an abrupt end at PO Box 3483 on Tortola island, in the British Virgin Islands (BVI).

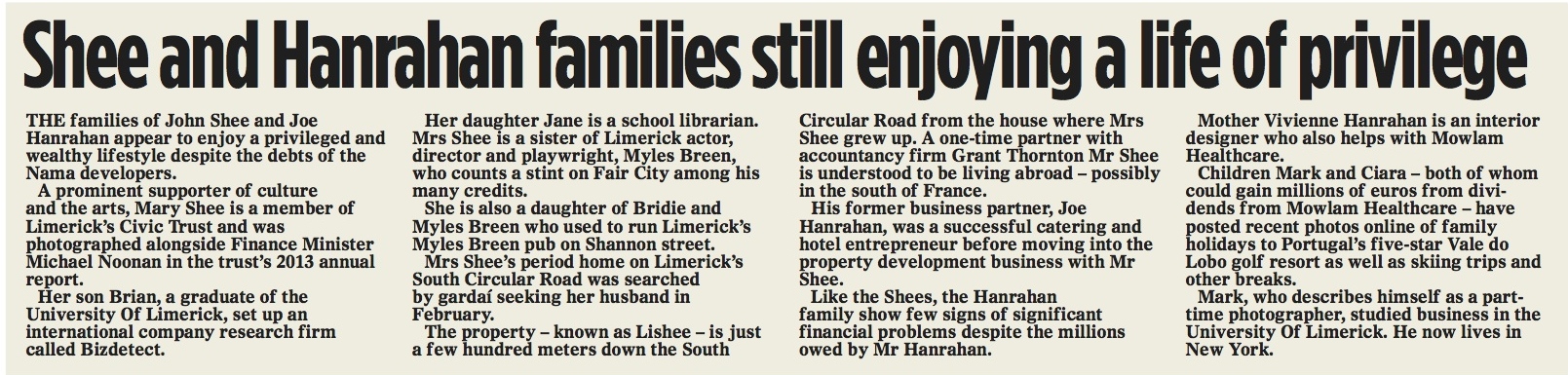

Tortola is the offshore haven of more than a million secretive and impenetrable corporate entities, including two recently established companies called the Sezana Group and Asvana Holdings – both with registered addresses at PO Box 3483. And it’s in these secret companies that the ownership of Mowlam Healthcare is now vested. Mr Shee moved to divest his assets in 2009, when he transferred the family home and several apartments to wife Mary. In 2011, Mr Hanrahan also transferred the family home to his wife Vivienne, weeks after the mortgage was paid off. Additionally, the men transferred three Limerick apartments they jointly owned to their wives.

In May 2011, the developers also divested their ownership of Mowlam Healthcare, dividing their shares between their wives and a third owner of the business – former Shannon Airport chairman Patrick Shanahan. Mr Shanahan, who is not in Nama, remains a director of Mowlam Healthcare.

Until last year, Mary Shee vested her ownership of Mowlam Healthcare in a separate company called Rivella Holdings Ltd. Vivienne Hanrahan and Patrick Shanahan and his wife and family also established holding companies. The three companies are unlimited, which means they do not have to file public accounts, and each has a similar clause, guaranteeing the men’s wives the first €2m paid out in dividends from their ownership of Mowlam Healthcare each year, with the rest going to their children. In Mr Shanahan’s case, the first €2m goes to Mr and Mrs Shanahan, with the remainder going to their family.

The three families then began to move their ownership of Mowlam Healthcare offshore through a series of complex financial manoeuvres, eventually vesting the ownership of Mowlam Healthcare in Sezana Group and Asvana Holdings. From that point, it became impossible to follow any further ownership changes at Mowlam.

The MoS put a series of questions to Mowlam Healthcare concerning the reasons for this offshore move and why the firm changed its articles of association, allowing it to ‘make a gift or to transfer’ and to ‘dispose of the whole or any part of the business…for no consideration whatsoever’ – to essentially give away assets for free.

We also asked Mowlam what dividends had been paid to its owners since it went unlimited in 2012.

Mowlam Healthcare declined to answer our questions.