By: Michael O’Farrell

Investigations Editor

MORTGAGE campaigners New Beginning sold a database containing the financial details of more than 1,000 struggling homeowners to a €2bn investment fund that aims to buy up 15,000 distressed homes here.

The data includes the value of the home and mortgage, the size of the household and after-tax income for AIB, Ulster Bank and Bank of Ireland customers. Confidential documents reveal that the Malta-based fund Arizun used New Beginning’s database to calculate the profitability of the scheme before approaching Irish banks to negotiate the purchase of thousands of distressed loans.

The database should have been redacted to comply with data protection laws so that names and addresses would not be passed on.

Instead, on August 25 an unredacted database was emailed from New Beginning to Arizun.

In a statement last night, the Data Protection Commissioner confirmed that an investigation into a data security breach under the Personal Data Security Breach Code of Practice is now under way.

The Irish Mail on Sunday has confirmed that the fund and New Beginning – which codenamed the deal Project Cowboy – formally approached banks just two weeks ago offering to purchase 5,000 non-performing mortgages from each bank for €720m, an average €144,000 per home.

The ‘cowboy’ nickname for the deal – also dubbed ‘Little Nama’ – is derived from Arizun’s US-born director John L McDaniel, the son of a one-time top US military official.

After securing the homes as assets, Arizun will generate income by renting them back to families for seven years or longer, after which residents can choose to buy their house back; and by selling bonds on the financial markets.

In return for the information and lobbying services, New Beginning was paid €20,000 and put on a €5,000 monthly retainer for three months.

According to letters of assurance provided by Arizun, New Beginning also stands to gain as much as €5m if all targets are met.

The documents also refer to ‘a sourcing fee’ of 3% of any equity raised for the fund which would be available to ‘New Beginning, its directors or officers’.

On top of the possible €5m, the organisation could earn set fees of €150 per transaction for being the exclusive provider of conveyancing services as homes are taken over by the fund.

Further fees of €100 will be earned each time New Beginning secures social welfare payments to help families rent their home from the fund. This means the fund will be paying New Beginning to ensure that the taxpayer pays rent allowance to residents who cannot afford the rent on their own former home.

Together these fees could be worth in excess of €3.75m. On August 25, the day the database was sent, Arizun paid New Beginning €20,000 (plus €4,600 VAT) according to a contract signed two weeks earlier on August 11.

New Beginning founder Ross Maguire formally reported the matter to the Data Protection Commissioner on Friday – the day after the MoS raised concerns about a possible data breach.

According to the code of practice a data controller should notify the commissioner of a breach within two days of discovering it. It also requires that anyone potentially affected should be immediately informed that their personal information has been disclosed. Asked why the matter had not been reported for more than three months, Mr Maguire said New Beginning had ‘no legal requirement to make a declaration to the commissioner’ though he accepted ‘that to do so is best practice as laid down in the code’.

Mr Maguire said he had verbally asked the Arizun fund to delete the data when he first learned of the breach around September 10 – and that he was ‘happy to accept their assurances that the information was deleted without seeking written guarantees’. He also said New Beginning would ‘this week write to each of the people on our database whose details were passed on in error’.

In recent weeks New Beginning has spoken publicly about the existence of a forthcoming ‘mortgage to lease’ scheme as a solution for Ireland’s debt-laden homeowners. It has never named any of the parties involved or which global funds had been approached to invest.

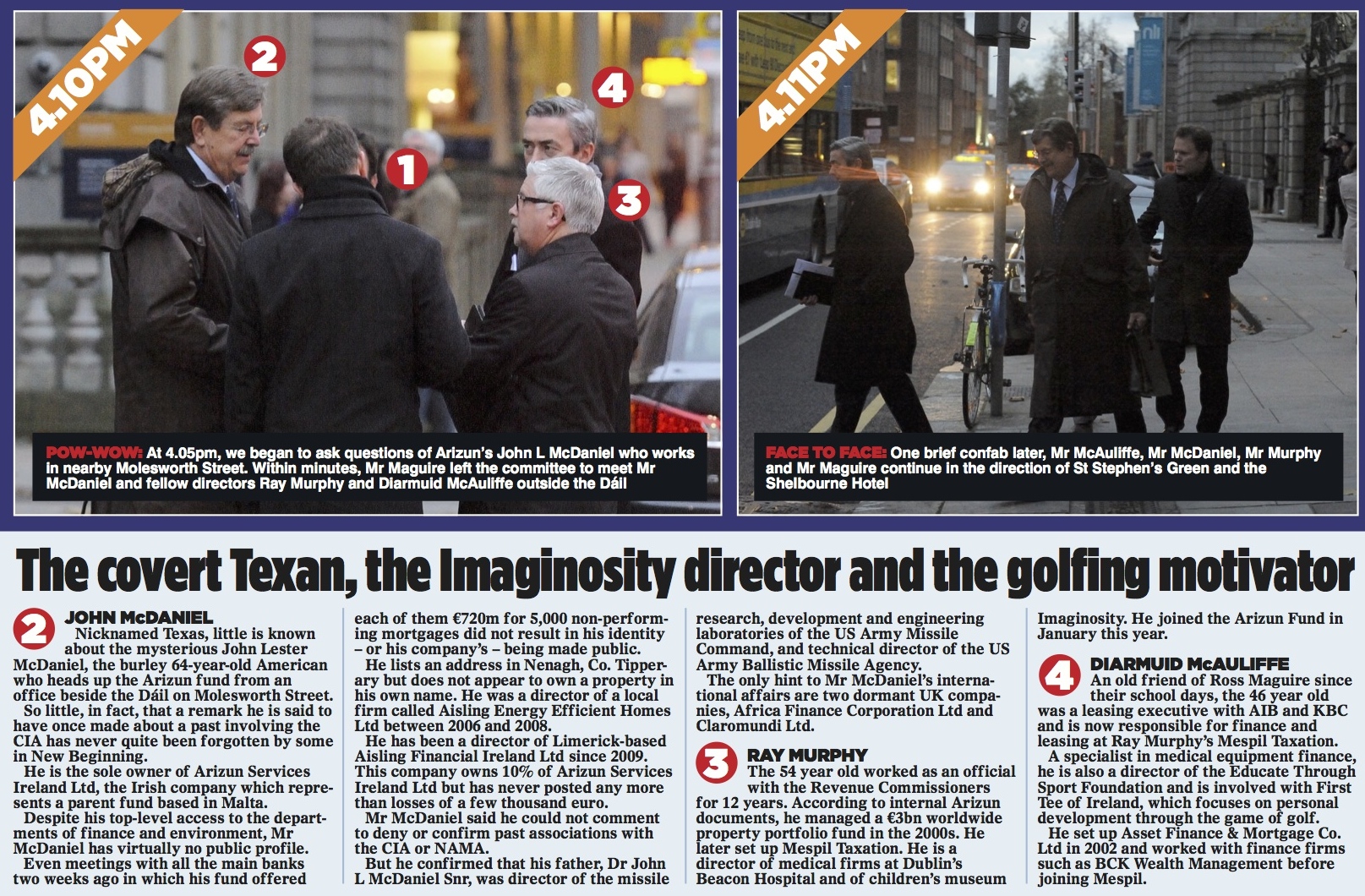

The MoS has confirmed however that Government support has been sought in meetings between New Beginning, Arizun and the Depart-ments of Finance and Environment.

More than 12,000 people struggling to pay their mortgage signed up to New Beginning and handed over their financial details. Assurances in the terms and conditions said: ‘New Beginning will maintain and keep all your information and any information relating to you in strict confidence.’ In a statement last night, Arizun’s Mr Murphy said both parties had been mindful of data protection.

‘Specifically, it was agreed that any statistical information provided to us would be of a nature that did not allow identification of any living persons by release of their name and/or address,’ he said.

He said the email with the database had been destroyed and not used. He did not however specify the date on which the data was destroyed.

‘Any analysis performed by us was in compliance with data-protection requirements,’ he said.

But internal documents obtained by the MoS provide an insight into how useful the data was to Arizun. In a briefing note sent to potential investors, such as global hedge funds, Arizun explained the benefit of partnering with New Beginning.

‘Though they are perceived as an non-profit social advocacy group, they have a commercial operation and will be fully remunerated for the work they will do for us. They also have excellent contacts at the highest levels of the current Government,’ the document reads. ‘They have details of over 10,000 clients … These people can form a substantial part of our NPL mortgage portfolios,’ the note continues.

In response to questions from the MoS, Mr Maguire apologised, saying: ‘We are sorry for this lapse’. ‘As well as ensuring that the data was destroyed and ensuring that we were not in breach of any data-protection regulations, we also hired a consultancy firm to review our data protection measures in general.’

He said New Beginning had ‘liked the mortgage-to-lease idea, not only because of the obvious potential benefits to struggling mortgage holders but because it had the potential to generate a new revenue stream for the organisation.’ Mr Ross said no New Beginning directors would benefit financially from the Arizun project.

‘For clarity, any revenue which New Beginning derives from this scheme will be used to subsidise our advisory activities. Our sole motivation is to implement a scheme that will save families from eviction.’ He confirmed New Beginning wished to transform into a commercial organisation but said: ‘When and if this occurs the mortgage-to-lease product will not form part of the commercial entity.

‘New Beginning Advisors, trading as New Beginning, is a non-profit company limited by guarantee. In the four years since its establishment the directors have not received a single payment from the company. In 2012 it has moved from being a voluntary organisation to a professional one which now employs 25 people. The directors and chief executive continue to work in a voluntary capacity.’

…………………………………………………………………………………………………………………………………………………………………………………………..

Footnote

The day the Mail on Sunday first published the above New Beginning story – November 30, 2014 – it was the lead item across all TV and radio outlets in Ireland.

Ross Maguire was interviewed by and apologised for the data sale on Savage Sunday on Today FM,on Newstalk, on TV3 and on RTE’s This Week radio show at lunchtime.

From there the story was the lead item on all RTE and other national radio and TV outlets all day. All national newspapers also followed up the next day.

Here’s the This Week clip – http://www.rte.ie/radio/utils/

Here’s clip of the lead on Six One TV News – http://www.rte.ie/news/player/

Here’s the lead on 9pm TV News – http://www.rte.ie/news/player/

Here’s Today FM basic news report – http://www.todayfm.com/

Here’s Savage Sunday Today FM Ross Maguire interview – https://player.fm/series/the-

Here’s Newstalk basic news report – http://www.newstalk.com/

Here’s some of the ensuing national newspaper coverage;

Sir, – The recent revelation (“Mortgage group apologises for data breach involving over 1,000 customers,” December 1st) that lobby group New Beginnings has passed debtor information to a so-called “vulture fund” is a reminder of the power given without question to these self-appointed spokespeople.

It is incredible that a group ostensibly set up to protect the homes of Irish families from repossession is now liaising with foreign speculators while ordinary families in Ireland cannot afford to buy homes.

Similarly, we see the presumptuously titled Irish Mortgage Holders Organisation announce plans to enter the mortgage brokering business – with all of the conflicts of interest that entails.

These two organisations style themselves as representative bodies yet they do not allow membership to the public and are incorporated as limited companies. They have been allowed to portray themselves as Robin Hood-type groups – now it is clear the reality is considerably different.

Far from offering a “new beginning” their back-room dealings are reminiscent of the worst of Irish life over the last decades.

The lack of scrutiny up to now reflects poorly on Irish journalism. – Yours, etc, MATTHEW GLOVER Lucan, Co Dublin.