By: Michael O’Farrell

Investigations Editor

THE wealthy owners of many of Ireland’s biggest domestic waste collection companies have set up ownership structures in offshore tax havens to hide their profits from public scrutiny.

As the bitter industrial dispute involving Greyhound Recycling enters its 13th week, the Irish Mail on Sunday can reveal that waste firms – some of which were found by the National Consumer Agency last year to be treating customers unfairly – are using locations such as the British Virgin Islands, Jersey and the Isle of Man to lodge hundreds of millions of euro that flows through their accounts each year. In fact, we can reveal that the practice of moving ownership offshore has now become the norm in Ireland’s lucrative waste sector.

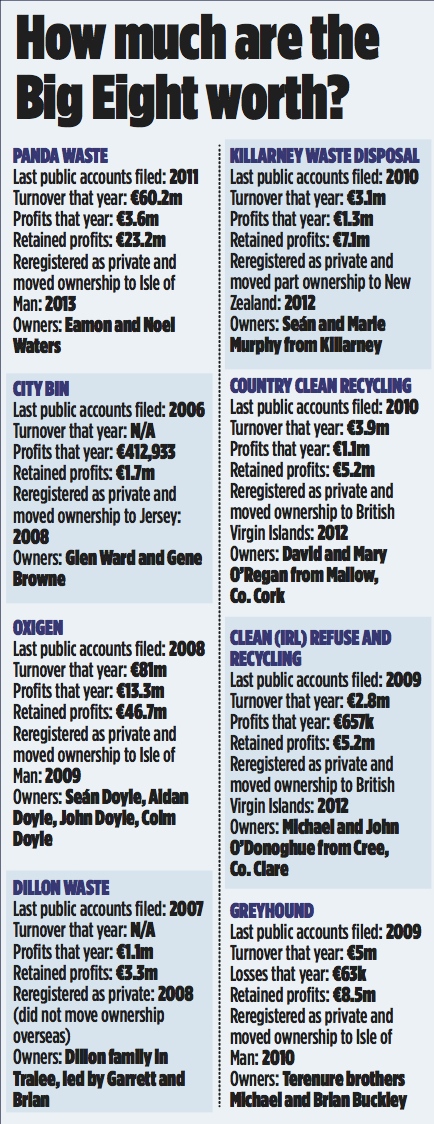

The MoS has traced the ownership structure of seven of the country’s most prominent waste firms – who have an estimated combined annual turnover of €200m – to holding companies in locations where financial anonymity is guaranteed.

Although some firms say they moved offshore to hide their accounts from competitors, the practice makes it impossible to establish how much profit those collecting your bins are making – and how much tax is being paid on the millions being generated.

The chairman of the Oireachtas Public Accounts Committee, John McGuinness, said companies that have taken over, or are awarded, State contracts of any kind should be transparent.

And he called on the Department of Local Government, and on each local authority, to examine the issue: ‘It would seem that an attempt is being made by some companies not to be transparent in the Irish market,’ he said.

‘That’s problematic in that we don’t know how healthy or otherwise these companies are, how much tax they are paying or what problems there may exist within those companies that could be stored up for the future in relation to the collection and disposal of refuse.

‘It is important that companies that get contracts from local authorities directly or from State agencies of one kind or another should be transparent,’ Mr McGuinness continued.

Our investigation reveals that nine of the country’s largest waste firms have in recent years re-registered their Irish companies as unlimited, meaning they no longer have to file public accounts. Seven of those have also created ownership structures involving offshore locations that hide their financial affairs behind an impenetrable veil of secrecy.

The arrangement also means that any changes in the ownership of the firms can remain secret. The companies involved include those that took over local authority refuse services in Dublin, Cork, Galway, Limerick and Kerry in recent years.

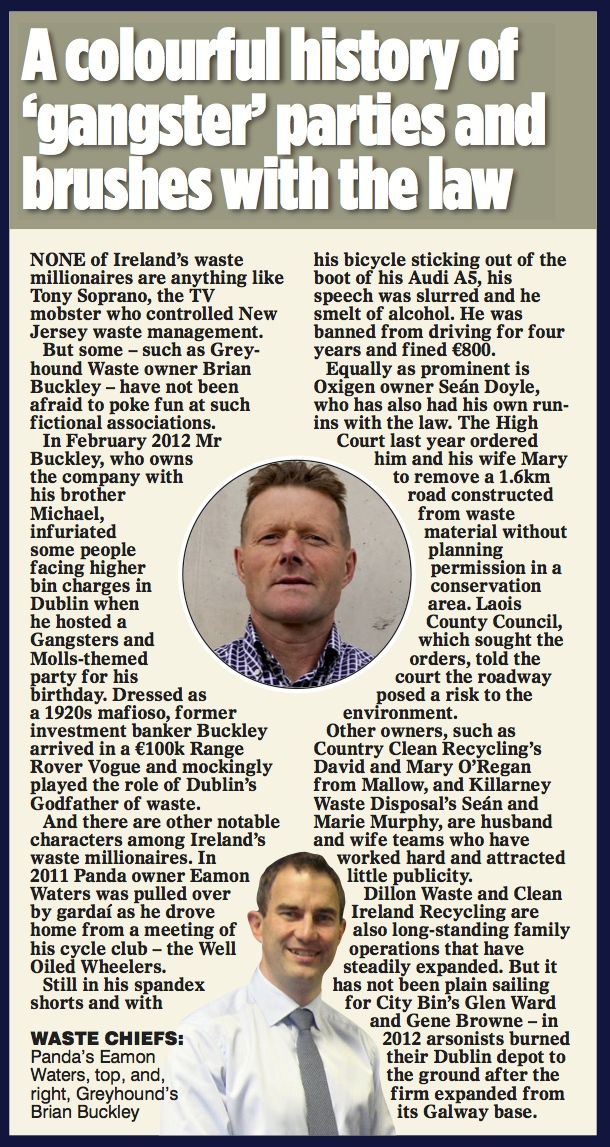

One such company is Greyhound Recycling, which took over Dublin City Council’s waste operations in January 2012, having acquired local authority routes in South Dublin the previous year.

The firm is embroiled in a lengthy dispute with workers that is affecting collection services despite the best efforts of the company’s management to provide strike-breaking replacement crews.

As first reported in the MoS, Greyhound re-registered as unlimited and moved its holding company to the Isle of Man to keep its accounts private just a week after taking control of Dublin city’s municipal waste collection.

At the time the company was sitting on €8.5m in retained profits – even after an overcharging debacle that saw it repay €1.3m to Irish Rail, as revealed in a Baker-Tilly consultant report in 2008.

Also in the Isle of Man are industry leaders Panda and Oxigen, which boast combined turnovers in excess of €150m annually.

Both companies were among six waste firms criticised by the National Consumer Agency last year for unfairly ‘exposing consumers to unspecified charges, altering of terms and conditions without a valid reason, and terms not being drafted in plain English’.

Panda made the move to the Isle of Man last year after posting retained profits of €23.2m the previous year. Oxigen had already set up there four years previously, vesting ownership – and the details of more than €46m in retained profits – in two offshore companies with the same address as the Isle of Man headquarters of chartered accountancy firm Grant Thornton. Neither Panda nor Oxigen responded to questions about why they made this move.

But a clue to Oxigen’s thinking can perhaps be gleaned from Grant Thornton’s Isle of Man website, which boasts that ‘we can provide services in relation to the setting up and administration of offshore structures for legitimate purposes, including tax planning…and confidentiality’.

Other Irish waste companies chose to locate their finances in the British Virgin Islands – an offshore hub where a population slightly higher than that of Sligo town presides over the administration of more than a million secretive and impenetrable corporate entities.

Mr Binman, which has 57,000 domestic customers in Cork, Clare, Limerick, Tipperary, Laois and Galway, was the first to take this route in 2008 after declaring a turnover of €14m in 2006.

At the time the company was owned by Kilmallock-based Martin Sheahan and his son Martin, who transferred their shareholdings to two BVI companies that share the address of Tricor – a Bank of East Asia company.

According to Tricor’s BVI website, the company ‘looks after your wealth in a safe and tax-efficient manner’. Mr Binman has since gone into receivership and an unrelated company – Valcroft Ltd – has purchased the business.

In a statement to the MoS, the new owners said they had not registered the new company as unlimited or moved ownership overseas. But others have followed the early example set by the original owners of Mr Binman.

These include Country Clean Recycling, which services 80,000 domestic customers in Munster. Owned by Mallow-based husband and wife David and Mary O’Regan, the firm paid Cork City Council €6m in 2010 to take over domestic collections there. In June 2011 it paid a further €4.6m for Cork County Council’s domestic collection routes.

Then, in February 2012, the company was re-registered as unlimited and ownership was transferred to two anonymous companies listed at a PO box address in Tortola, an island in the BVI.

Country Clean Recycling was among the firms cited as treating customers unfairly by the National Consumer Agency last year. The firm did not respond to questions and a request for comment from the MoS.

Meanwhile, customers who used to rely on South Tipperary County Council’s refuse service are now also seeing the profits from their bin charges wind up in the British Virgin Islands.

That’s because Clean Ireland Recycling, which took over the council’s waste services in 2011, is now technically owned by two BVI companies at the same Tricor address originally used by Mr Binman. The company registered as unlimited and moved ownership overseas in March 2012 – the same month it won Repak’s Kerbside collector of the year award.

In a statement to the MoS, Clean Ireland Recycling said that it made the move in order to avoid publishing ‘financial and commercially sensitive operational information that our competitors were in a position to easily access and take advantage of’.

Asked whether the move had been made for tax reasons, the company said it had cleared the restructuring with the Revenue Commissioners and now had ‘the same tax obligations to the Irish State that it always had and pays the same level of taxes in Ireland as it did as a limited Irish company’.

Another firm, Galway’s City Bin, re-registered and established an ownership structure in the Channel Island of Jersey in 2008 after posting retained profits of €1.7m in 2006.

City Bin was also one of those criticised for acting unfairly by the National Consumer Agency last year. Managing director Niall Killilea told the MoS that all taxes were paid in Ireland. ‘We registered part of our group in Jersey to simply keep our detailed accounts undisclosed from our competitors,’ he said.

‘This is common practice for hundreds of companies in Ireland.’ In Kerry, Killarney Waste Disposal ensured its accounts would remain private by registering as unlimited in 2012. At the same time the company restructured part of the ownership to New Zealand.

Owned by Seán and Marie Murphy, the firm bought the Kerry County Council contract in 2011 for €480,000 after the council’s refuse collection service lost €2.6m since 2008. Also in Kerry, Dillon Waste – owned by the Tralee-based Dillon family – reregistered as an unlimited company in 2008 after declaring profits of €3.3m the previous year.

Unlike many other companies, Dilllon Waste did not move its ownership overseas, choosing instead to rely on the privacy afforded by becoming an Irish unlimited company.