This article was first published in the Irish Mail on Sunday on 04/11/2012.

By: Michael O’Farrell

Investigations Editor

THE Irish Mail on Sunday can today reveal the extraordinary – and in many ways alarming – truth about the firm that has just become Anglo Irish Bank’s business partner in Russia.

Anglo, now known as IBRC, revealed last week that it has teamed up with a company owned by three controversial and colourful Russian oligarchs. The surprising move is a last-ditch bid by the bank to chase down and secure for the Irish taxpayer more than €300m in Quinn family assets.

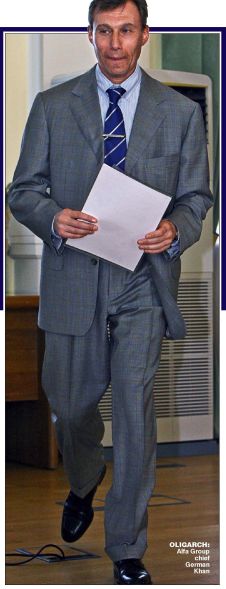

One of the firm’s bosses is German Khan, a selfconfessed gun fanatic with a private collection displayed in his Moscow office. Mr Khan no longer brings weapons to meetings as he did in the heady days of the 1990s. The practice was banned in 1999 under a new Russian law.

Mr Khan’s firm, Alfa Group Consortium – through a specialised branch of the company called A1 – will now be responsible for trying to recover $315m (€245m) in assets stripped by the Quinns.

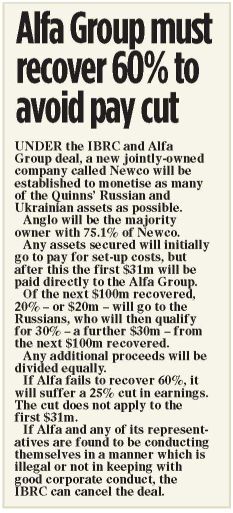

The deal, in which the Russians stand to gain as much as $80m (more than €60m) in commission for successfully returned assets, is a tacit admission by Anglo that it has all but failed in its efforts to secure almost a dozen assets in Russia and Ukraine.

Alfa Group, owned by billionaires Mikhail Fridman, Alexei Kuzmichev and the gun-loving Mr Khan, has vast interests in oil, mobile phones, banking and a wide range of other sectors. It is Russia’s largest privately owned consortium.

It is perhaps no coincidence that in Russia the name Alfa Group is also used by an elite, stand-alone unit of the state’s special forces which operates under the direct control of the Kremlin.

Alfa Group’s three owners have a combined worth of more than $33bn with Fridman beating even Roman Abramovich on the Forbes rich list.

Introducing the group this week, Anglo was at pains to stress the lengthy measures it had gone to in order to ensure that Alfa Group is an ‘appropriate partner for a State-owned entity’ such as Anglo.

The bank told the High Court it had carried out various strands of due diligence on Alfa – a process which involved speaking to the Irish Embassy in Russia, the Russian Ministry of Finance and the Department of Foreign Affairs.

However, the super-wealthy trio, who are known to enjoy an enviable relationship with the Kremlin, have also left behind an almost mythical trail of colourful business escapades and endeavours from the time they first emerged as players in the post-Soviet Russia of the 1990s.

Nowhere in the carefully crafted Anglo rhetoric released this week, however, was there any mention of such matters. Yet it is a simple and easily discoverable fact that many who have gone into business with Alfa Group came out the worse for wear for it.

In fact, some of Alfa Group’s business associates have found themselves in the midst of extraordinarily aggressive battles even though – like Anglo – they were actually in partnership with Alfa Group’s owners.

Those ill-fated partnerships have seen both sides levelling astounding allegations (not just against Alfa) which include insider trading, the payment of journalists to write negative propaganda, international industrial espionage and electronic eavesdropping.

Perhaps most famously, petroleum giant BP has been through years of litigation with Mikhail Fridman and his partners since they formed a joint venture oil firm TNK BP in 2003.

Relationships between BP and the Russians were always fraught and even led to Bob Dudley – now the head of BP as a whole – fleeing Russia completely. Prior to his departure, Mr Dudley’s office had been bugged and raided by police and the authorities had bombarded him with onerous backtax demands and visa problems. After years of poor relationships with its Russian partners, BP has only this month sold its way out of the deal with many attributing its pulling out to the poor state of relations in the venture.

Cables from the US Embassy in Moscow, leaked last year by Wikileaks, give a fascinating, if daunting, insight into Alfa Group’s German Khan.

The cables recount a hunting trip that BP executive Tim Summers took with the oligarch. Although married with three children, Mr Khan travelled to his rural hunting lodge – which, according to the cables, is ‘like a Four Seasons hotel’ – with seven glamorous women. When he came down to dinner he was ‘armed with a chrome-plated pistol’ and told his guest that he watched The Godfather movie every few months and considered it ‘a manual for life’.

According to the diplomatic cable, Mr Summers bought ‘a copy of The Godfather and said he watched it on a regular basis himself so as to better understand Khan and anticipate his tactics’.

Mr Summers concluded his thoughts with the observation that his host was a typical Russian businessman who did ‘multimillion euro deals in a smokefilled room in a few hours and only later turned them over to the accountants to see if they made sense’.

In a more succinct assessment another cable quoted another BP official indicating that Khan might be ‘certifiably deranged’.

Generally though Mr Khan, a keen amateur boxer, has a reputation of being tough, ruthless and reclusive. His partner, Mikhail Fridman – the wealthiest of the three – also has a formidable reputation although he appears on the surface to be jolly and affable.

In a 2010 lecture he gave in his native Ukraine, he described the secret of his success as being born in the Ukraine and then coming to Moscow at the ‘right time when the empire starts to collapse’.

‘I think that of all the types of human activity, entrepreneurship is, in some sense, the closest to war,’ he told his audience.

He went on: ‘When I look back at my modest business activities over the last 20 years, I sometimes think that it reminds me of a good thriller, which so far has a happy end.’

There was no happy end, however, for Telenor, the Nordic region’s largest telecoms company, after it formed a partnership with the Alfa Group firm Altimo in 2004 to control Russian and Ukrainian phone companies.

Much like BP, Telenor found itself embroiled in a series of court actions with its own partner and eventually accused the Russians of insider trading.

Similar problems were encountered by others such as Swedish-Finnish group TeliaSonera, which jointly owned Turkish and Russian phone networks with Alfa Group.

Other telecoms partners of Alfa suffered similar fates – something that led a New York judge to describe as a ‘history of collusive and vexatious litigation’.

The former chairman of the US Federal Reserve, Paul Volcker, also cited Alfa Group in a report into corruption in the UN oil-forfood programme in Iraq. Alfa denied it channelled any money to Saddam Hussein’s regime but the report criticised the firm for failing to answer questions on its involvement.

Another controversy involved a probe by the US House of Representatives’ chief investigations committee when it was alleged that Alfa Group hired an international investigative agency known as Diligence to obtain confidential information about a Bermuda firm which owned Russian telecom assets.

The alleged ruse – which was strenuously denied – involved operatives impersonating secret service agents to trick third party auditors into providing them with confidential files. Despite these controversies, Anglo has taken what may be seen as a bold but desperate step in hiring the controversial firm.

Crucially though it is acknowledged that Alfa Group’s consortium of billionaires enjoys excellent communication channels with the Kremlin. A recent paper from Oxford University’s Institute for Energy concluded that the group ‘can command direct access to Vladimir Putin and Dmitry Medvedev while bypassing any government gatekeepers’.

The Anglo-Alfa deal, which involves the bank and the Russian group as joint partners in a special purpose vehicle of which Anglo owns 75%, is one which some at the bank privately concede could easily backfire on them. That is because the bank is about to, for the first time, play the Quinns at their own game. In Russia that means not necessarily playing fair.

In seeking to put their assets beyond the reach of the bank, the Quinn family readily used Russian law firms which to this day are successfully using mysterious methods to pull the rug from under any of the bank’s attempts to regain ownership of the assets.

Time after time share pledges are mysteriously overturned, bankruptcies are switched and court orders are reversed leaving the bank’s investigators back where they started. Now the bank has chosen to rely on the same kind of advice and expertise the Quinns availed of by paying a Russian firm to do what only Russian firms can.

Anglo is gambling that Alfa Group can negotiate the largely grey and nebulous quagmire that passes for corporate law in Russia without getting caught doing anything too untoward.

That’s a thin line for a bank owned by Irish taxpayers to tread – especially given Alfa Group’s past.

ENDS