This story was first published in the Irish Mail on Sunday on 21/10/2012

By Michael O’Farrell

Investigations Editor and Georgina O’Halloran

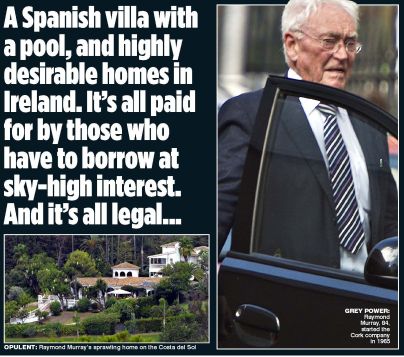

THIS is Ireland’s most reclusive and successful moneylender – on a brief trip home from his sun-kissed Marbella mansion.

A world away from the many underprivileged Irish communities where his company makes millions by charging interest rates in excess of 200% on small cash loans, Raymond William Murray lives a life of luxury and opulence.

Photo credit – Michael Chester

And it’s all entirely legal. Behind high electronic security gates and pristine whitewashed walls, his lavish villa – complete with pool and live-in housekeeper – has direct, private access to the El Paraiso Golf Club.

One of Spain’s oldest and most prestigious courses, the club’s fairways extend across the base of the peaceful El Paraiso valley beneath mountains to the north and the sparkling Mediterranean to the south.

Back home on Cork’s northside, Mr Murray’s moneylending company, Marlboro Trust Ltd, occupies an ugly, sprawling warehouse perched on a drab hillside overlooking the largely deprived community of Mayfield.

The area contains the second highest concentration of local authority housing in Cork (58.6%) and has been identified as one of the State’s worst unemployment blackspots, with more than 23% of working-age inhabitants permanently out of work. Less than 1% of the children here go on to third-level education.

Golf is not a preoccupation in these parts. But the underprivileged people of this community and scores of others like it have for decades funded the golfing activities and privileged lifestyle of Mr Murray and his family.

Depending on one’s viewpoint, moneylenders like the Murrays are either considered merchants of misery who profit from the misfortunes of others – or a vital lifeline allowing people credit when they otherwise would not get it. Either way, Marlboro Trust is certainly not suffering in the face of a deep recession.

In fact, the prevailing troubles of the main banks – two of which are closing their Mayfield branches – will likely increase the demand for Marlboro’s credit services.

The Murray family continue to make vast profits from lending. They are now among the biggest landlords in Ireland, with hundreds of rental properties to their name.

At present, Marlboro Trust – the Murray’s main holding company – is licensed by the Financial Regula-tor to give cash loans for periods of 21 days at an interest rate of 72.51% and an additional collection fee of 14 cents per euro. This equates to an astonishing 210.7% APR – more than enough to fund a privileged lifestyle which includes several trophy homes, luxury cars and the princely Costa Del Sol villa.

Yet Mr Murray and his family have managed to remain largely anonymous. Despite running one of Cork’s top 20 companies, the family have never before been profiled in any newspaper or photographed publicly, although they are well known among Cork’s affluent merchant classes.

Now semi-retired, 84-year-old Raymond William Murray established the business from a base at No 4 Marlboro Street Cork on April Fool’s Day 1965, simply calling the company Ray Murray Ltd. In the 1980s Mr Murray was tipped as a possible election candidate for Fianna Fáil.

However, following a 1985 Today Tonight documentary, which partly featured his business, he moved to Spain, although he still keeps a home in Cork. By the time he changed the name to Marlboro Trust in 2004, he had almost 60 collection agents (known in the business as travellers) using a €250,000 fleet of cars collecting door-to-door repayments each week throughout the country.

Although still a director, Mr Murray handed over his shares and day-to-day control of the family business to his sons, Finbar and Kevin, and a daughter, Cathryn, between 2004 and 2011. Today the moneylending business is run through a subsidy called Marlboro Trust (Finance) Ltd, which made loans of €5.5m in 2010 and posted a retained profit of €4.8m.

Photo Credit – Michael Chester

Since loans are typically small – in the hundreds of euros – the figures indicate that tens of thousands of struggling families, who could not otherwise obtain money, availed of credit from Marlboro despite the punishing interest rates.

With most banks and credit unions effectively shut for lending, the Murrays have little doubt that demand for their services will continue to grow.

‘Despite the prevailing economic conditions, the directors expect the present level of activity will be sustained in the coming financial year,’ a note to the current company accounts reads.

Through another subsidiary, Marlboro Trust (Retail) Ltd, the Murrays are making further millions.

Based in the sprawling Marlboro warehouse overlooking Mayfield, this is a massive retail credit business which provides goods for inflated prices based on weekly repayments.

Inside the front door of the building, which opens out into Mayfield’s Aldi carpark, is a reception area where catalogues of household furniture are displayed.

Beyond that, through a door that must be buzzed open by a staff member, a vast shop floor is stocked high with everything from shoes to sports gear and toys. Behind counters, sales staff deal with phone and face-to-face queries about electronic equipment such as computers TVs and jewellery.

Everything a busy home with young children could ever need is here – at a price. Instead of lending money to buy the items, the company provides the items themselves at a premium price that already has the interest front-loaded. Repayments are then collected over 20 weeks from homes by the company’s 66-strong fleet of collection agents.

The clever arrangement allows the company to advertise ‘interest free credit’ on all its retail goods. Attractive, glossy catalogues, distributed to thousands of homes, state ‘APR Zero – Easy Confidential Weekly Payments’.

Credit agreement dockets issued with sales make the same claims in bold black ink. ‘Cash and credit price the same. APR Nil.

Orders can be phoned in and delivered directly to your door but the prices in the catalogues – frontloaded with interest – are far more than the same items would cost in nearby shops.

The MoS compared prices in the company’s latest sports catalogue with those available in Cork’s high street and found that Murray Trust customers are often paying between €20 and €30 more for items such as trainers and clothing (as detailed elsewhere on this page).

Company accounts reveal that the Murrays’ retail credit business is booming. It far surpasses the family moneylending business. Last year the company, which employs 134, had a turnover of €15m, made a gross profit of €8.1m and was sitting on retained cash profits of just over €15m. The directors – including Raymond Murray – paid themselves €1.1m.

Many more millions are resting in other Murray family companies. Hillcrest Holdings – a property rental company – posted assets of €8m in 2009 with retained shareholder funds of €4.8m. Another company – Adam And Eve Ltd – holds assets of €3.4m and made a profit of €1.7m in 2011. Yet another – GS Securities – holds assets of €2.7m and made a profit of €811,000 in 2011.

Cork Sinn Féin councillor Chris O’Leary told the MoS he was more than familiar with the Murray family’s operations. In particular, he says, they are renowned for knocking on doors in working-class areas when Christmas, a new school term or First Communion was imminent.

‘I’m very much aware that people are increasingly using the services of legal moneylenders recently for school uniforms and getting the children back to school.

‘They will probably go back to them in the coming weeks to get things for Christmas off them… they are in a cycle of perpetuating poverty,’ he said ‘I’ve seen these door callers in working-class areas in vans and people go to look at the goods. They decide to buy something and get caught up in a cycle.’

Labour councillor Michael O’Connell, who is also a volunteer with Gurranabraher Credit Union, said people going to moneylenders had become a huge problem, particularly over the past four or five years.

‘The economy crashed. Things are very tight and people with young families are being lured into a fake sense of security with the initial loan. After the initial loan, you get sucked in. It’s easy to get a further €200.’

While not commenting on Marlboro Trust in particular, Mayfield Workers Party councillor Ted Tynan said he had no time for the industry. ‘They feed off people, particularly in times of recession,’ he said . ‘There are always a number of people living just above the poverty line and they are slipping below that.

‘They might be in trouble with the bank and might have a loan with the credit union and an emergency comes up and they are driven into the hands of the moneylenders .

‘This needs to be tackled. They should not be able to charge such high interest rates. It’s a total rip-off.’

But Money Advice and Budgeting Service (Mabs) spokesman Michael Culloty said cutting interest rates for legal moneylenders would eliminate their business and drive people into the hands of illegal moneylenders .

In reply to questions from the MoS, the company issued this statement: ‘The company is compliant, regulated, and audited annually. The company operates under licence, strict rules and guidance from the Central Bank

‘The company has been in business for over 50 years and employs over 130 people in fulltime pensionable employment.’

ENDS

Marlboro selling trainers and tracksuits ‘interest-free’, but first it jacks the prices way up. The following list shows the difference between Marlboro’s credit retail prices and those available in the high street.

1 A Nike crest women’s hoodie in pink, pictured, in catalogue for €69 and at Lifestyle Sports for €55.

2 Nike children’s sports shoes labelled Court Met in the catalogue cost €59. On sale at Maher’s Sports for €41.

3 A pair of Ecco shoes labelled in the catalogue as E32235 on sale for €180 were available at the Ecco store on Patrick Street, Cork, for €160.

4 Children’s converse all star red runners (Sizes 10 – 2), labelled Chuck Taylor in the and on sale at Lifestyle Sports for €50, having been reduced from €75.

7 Nike children’s sports shoe, pictured, labelled Court LDS in the catalogue cost €93. They were on sale at Maher’s Sports for €68.

8 Women’s Adidas tracksuit in green and purple offered in the catalogue for €90. Same item at Maher’s Sports cost €45, reduced from €68.

9 A pair of Ecco boots labeled E32234 in the catalogue are on sale for €205 and were available at the Ecco store on Patrick Street, Cork for €185.

10 A blue and white Adidas tracksuit on sale in the catalogue for €90 was available at Maher’s Sports for €45, reduced from €68.

11 Nike girl’s warm-up suit, pictured, on offer in the catalogue for €59 but on sale at Maher’s Sports for €42.

12. A black Canterbury base layer for men pictured, on sale in the catalogue for €50 in the catalogue, cost €40 at Lifestyle Sports on Patrick Street.

13 Grey Canterbury women’s tracksuit trousers, on offer in the catalogue for €59, were on sale at Lifestyle Sports at €45.

14 A purple Canterbury women’s hoodie on sale for €70, was available at Lifestyle sports for €50 and at Maher’s for €48.