This article was first published in the Irish Mail on Sunday newspaaper on 12/08/2012

By John Breslin

Developer Seán Dunne has been publicly accused of hiding millions of euros of assets from NAMA.

The claim has been made in US court documents, which claim he siphoned off the money through a series of countries and companies to dodge paying his debts.

The one-time ‘Baron of Ballsbridge’, who admits he owes almost €200m to Irish taxpayers, now faces a court hearing in October in Connecticut over his alleged role in property deals that netted millions of dollars.

Dunne is being sued in the American court by a subsidiary of the National Asset Management Agency, which accuses him of fraudulent activity for trying to hide the proceeds of the sale of an apartment in Geneva, Switzerland and of two houses in the US.

The properties were first revealed in the Irish Mail on Sunday, and the MoS articles are included in the 288-page submission as exhibits of evidence, the only newspaper cited.

The court papers claim Dunne and Killilea are living ‘lavish’ and ‘opulent’ lifestyles.

Essentially, Dunne is accused of banking close to $9m, despite his agreeing earlier this year that he was personally responsible for €185m in loans taken over by NAMA.

The lawsuit is aimed at stopping Dunne getting any benefit from the proceeds of the sales of two homes in Connecticut and one in Geneva. A third house in the US remains unsold.

It was filed just days after the completion of the sale of 38 Bush Avenue in the exclusive Belle Haven enclave of Greenwich, bought for $2m, controversially torn down and rebuilt at a cost of more than $1m, then sold last month for $5.5m.

Five days later NAMA lodged their case asking the court to prevent Dunne, his wife or agents from transferring any more money or assets.

In total, Dunne is accused of making profits or holding assets of some $9m that he has failed to reveal to NAMA.

The documents reveal that he swore, on oath, a statement of his assets – but NAMA claims he left out properties worth millions.

The NAMA affidavit also reveals that the agency only became aware of this alleged discrepancy when they read it in the MoS.

Among the most significant claims made in the court filings, the agency said: ‘Dunne and his wife, defendant Gayle Killilea Dunne, have utilized a number of lawyers, purportedly acting as trustees, and shell companies to hide assets from creditors, including the Plaintiff’.

It goes on to claim: ‘Dunne’s conduct has made it difficult if not impossible to trace the flow of Dunne’s assets and reach those assets in satisfaction of the Judgment… given Dunne’s financial sophistication and the Dunnes’ established record of using lawyers and LLCs to hold their assets, ex parte relief is necessary to preserve the status quo and prevent irreparable damage or loss to [Nama]’.

Referring to co-defendants in the suit – who include several lawyers who have acted for the Dunnes – the documents state that ‘there is a reasonable likelihood that Dunne and/or Killilea, with the assistance Heagney, Slane and/or Slane Lennon, are about to, and have already, fraudulently disposed of property with intent to hinder, delay or defraud Dunne’s creditors and/or that Defendants have fraudulently hidden or withheld money, property or effects which should be liable to the satisfaction of his debts.’

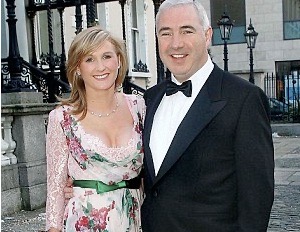

High circles: Seán Dunne and Gayle with then taoiseach Bertie Ahern at Punchestown Races in 2008

High circles: Seán Dunne and Gayle with then taoiseach Bertie Ahern at Punchestown Races in 2008The action taken in the Connecticut Superior Court is ‘based on his failure to repay amounts demanded’.

The complaint reads: ‘NALM [National Asset Loan Management] alleges that Dunne and wife, defendant Gayle Killilea Dunne, have utilized a number of lawyers, purportedly acting as trustees, and shell companies to hide assets from creditors.’

NAMA, through its subsidiary NALM, claims Dunne set up four different companies in the US, but tried to hide his links to them.

‘Plaintiff also brings suit against Killilea, Mountbrook USA, Molly Blossom, Barclay and Wahl as suspected transferees of Dunne’s assets.’

A series of MoS articles are used as evidence

Dunne insists that he never had any interest in the Geneva property, in Mountbrook USA or in any of the US properties he and his wife have been connected to.

It is expected he or she will argue that they are wholly unrelated to any debts that he owes and NAMA has no call on them, and that therefore there was nothing wrong with any of the purchases or sales of the properties.

NALM is based in Dublin and is part of NAMA, and is being used by the state property behemoth to enforce court judgments made against developers.

In court papers Seán Dunne is described as a businessman, company director and an Irish citizen, ‘believed to be residing at 421 Field Point Road in Greenwich’.

Co-defendant Gayle Killilea Dunne is married to Seán Dunne and is an Irish citizen.

‘Killilea previously worked as a columnist for an Irish newspaper,’ the documents state.

This last part of the biography is important as NAMA argues that it means she would not have the money or assets to pay for the hugely expensive properties linked to her name, claiming that in fact they were bought with her husband’s earnings.

The filings state: ‘Killilea has no identifiable sources of income and never earned enough income to purchase and renovate or construct the Greenwich Connecticut properties, let alone purchase the Geneva apartment for millions of Swiss Francs … Nonetheless, they live an opulent lifestyle in Greenwich.’

But the Dunnes are not the only defendants; also named in the court filings are several companies NAMA claims Dunne and his wife control: Mountbrook USA, Molly Blossom, Wahl and Barclay, Beattie and Brown.

The registered address for the companies, except the last, is a solicitor’s firm in Greenwich called Heagney, Lennon & Slane.

Two of the lawyers, Thomas Heagney and John Slane, are also named as defendants, with claims they helped Dunne and his wife in their various property transactions.

Apart from the properties, Nama also claims the couple’s two cars, a $36,000 Lexus SUV and a $7,000 Jeep Cherokee are owned by a company.

Nama had asked for a quick interim judgment blocking the couple from making any financial moves because ‘the Dunnes possess the motive, means and history of transferring assets beyond the reach of plaintiff’s attempts to enforce the judgement’, NAMA asset recovery manager John Coleman wrote in an affidavit.

However, it was not granted, and a full hearing will take place in October, when the defendants will have an opportunity to respond.

The court filings also claim that immediately after Dunne filed his statement of financial affairs in late 2010 as requested by Nama, documents filed with the Connecticut Secretary of State were changed. These documents related to Mountbrook USA and Molly Blossom, two companies Nama says are controlled by Dunne.

‘The interim notices purported to modify the LLCs original organisation documents by replacing Dunne with Killilea as member of the LLCs and stated that Dunne was ‘listed in error’.”

Neither Dunne, his wife, nor any of the other defendants, have filed replies to the complaint. Indeed, while Killilea has hired a lawyer, her husband has not yet.

But in a letter contained in the court documents, Dunne expresses his frustration with NAMA, complaining that the agency’s review of his business plan, ultimately rejected, was being influenced by press speculation.

In the February 2011 letter replying to questions about, among other matters, the purchase and sale of the Geneva apartment, Dunne wrote: ‘I am totally committed to working with NAMA and working out my assets that are now under the control of NAMA but it is very debilitating for me and my team to be left wondering from day to day what is happening.’

He argued that the purchase and sale of the Geneva apartment does not come under Nama’s jurisdiction.

Dunne ‘tried to hide his links to US companies’

But Dunne added that his wife was the sole owner of the property, bought for €3.8m and sold for €4.4m. His name was initially included in documentation purely for residency requirements, he claimed.

‘I did not contribute any equity or pay the mortgage and Mrs Killilea insisted and I agreed that I be removed from the property documentation.

‘As I never held any interest in the property we considered the matter when formulating my statement of affairs and concluded it was never an asset and no beneficial transfer occurred.’

Dunne also denied being involved with Mountbrook USA, the company whose sole member is Gayle Killilea. He blamed New York lawyer Philip Teplen for putting his name on documentation filed with the Connecticut Secretary of State.

NAMA launched the action in the US to enforce the €185m judgment made by the High Court in Dublin in March.

It has also asked for a temporary restraining order freezing all the cash generated by the sale of the properties.

The State agency says it has not been able to locate any of Dunne’s assets.

‘Although NALM has been unable to locate assets owned by Dunne that are available to satisfy the judgment, Dunne and his wife have continued to life a lavish lifestyle in Greenwich since relocating from Dublin, Ireland,’ NAMA states in a filing asking for an immediate block on any movement of cash by the couple.

‘They live in a Greenwich mansion that rents for approximately $17,500 a month and drive several luxury vehicles.’

Luxury: Gayle Killilea and Seán Dunne are alleged to be living opulently in the US

Luxury: Gayle Killilea and Seán Dunne are alleged to be living opulently in the US

One of those vehicles is a $36,000 Lexus SUV, the other a Jeep Cherokee.

‘Dunne apparently has no assets or income available to satisfy the judgment.

‘Moreover Killilea has no identifiable sources of income and never earned enough income to renovate or construct the Greenwich, Connecticut, properties let alone purchase the Geneva apartment for millions of Swiss francs,’ wrote NAMA asset recovery manager John Coleman in an affidavit.

‘Nonetheless they live an opulent life style in Greenwich and have purchased, constructed and/or sold properties worth millions of dollars.’

It is further claimed that a company linked to Dunne, Mountbrook USA, paid real estate taxes on two of the properties, this despite the property developer claiming it has no assets.

The action taken in the Connecticut Superior Court is ‘based on his failure to repay amounts demanded’.

‘They omitted details of property purchases’

The complaint reads: ‘NALM alleges that Dunne and wife, defendant Gayle Killilea Dunne, have utilized a number of lawyers, purportedly acting as trustees, and shell companies to hide assets from creditors.’

NAMA, through its subsidiary, claims Dunne set up four different companies in the US, but tried to hide his links to them.

‘Plaintiff also brings suit against Killilea, Mountbrook USA, Molly Blossom, Barclay and Wahl as suspected transferees of Dunne’s assets.’

NAMA secured a judgment in March against Dunne for €185m, stemming from ‘defaults on numerous development loans that were advanced during the last decade by various Irish banks to Dunne personally and to Dunne’s companies’.

On the application of James Doherty, for the agency, and on foot of a written consent Mr Dunne provided through his lawyers, Mr Justice Peter Kelly entered summary judgment in the amount of €185,299,627.

The judge also granted the agency liberty to apply to enforce the judgment if necessary. Mr Dunne was not in court for the brief hearing.

The nine separate loan facilities at issue were made by Bank of Ireland, Irish Nationwide Building Society and Allied Irish Banks on dates from 2005 onwards to Mr Dunne personally and to various companies.

Residence: The mansion at Field Point Road, Greenwich

Residence: The mansion at Field Point Road, Greenwich

Grand: The house at 38 Bush Avenue

Grand: The house at 38 Bush AvenueMr Dunne had provided guarantees related to loans to various Mountbrook Companies, the Riverside 4 Development and DCD Builders.

NAMA acquired the loans in July 2010 and initiated the court proceedings after demands for repayment by July 2011 were not met. Mr Doherty said the matter involved complex layers of security and required careful analysis by the agency to ensure the figures were right before it brought the proceedings.

Mr Doherty also said NAMA had made a number of efforts to serve Mr Dunne personally with the proceedings before he was ultimately served on December 22 last.

That service did not go as planned as Mr Dunne was served with original documents and not copies – but Mr Dunne had later returned the originals, he said.

Mr Justice Kelly said he was satisfied to transfer the proceedings to the Commercial Court and to enter summary judgment as sought. The court judgement, to which Dunne agreed, concluded discussions that went back to November 2010, when NAMA first asked Dunne to submit a business plan and give details of his financial assets.

NAMA also wanted details of his wife and children’s financial affairs.

In December 2010, Dunne submitted a statement of financial affairs in which he claimed to have made no transfer of assets other than five minor ones.

He did not mention any property transactions in the US or Switzerland, it is claimed.

‘I am not a shareholder of Mountbrook USA’

‘Despite the declaration under oath attesting to their completeness, these representations omitted details of the Switzerland transfer and property purchases’, the documents in the US proceedings allege.

Details of four property transactions, in Switzerland and the US, are contained in the US papers.

The apartment in Geneva was bought for 4.6m Swiss Francs (€3.8m) in July 2008.

In February 2010, Dunne transferred his half interest in the apartment to his wife. A month later, Gayle Killilea signed a contract to sell the apartment for 5.3m Swiss Francs (€4.4m). This was publicly revealed by the MoS and the article is attached to the complaint.

The article led directly to NAMA asking Dunne about the property.

‘Dunne failed to disclose the transfer of his interest in the Geneva apartment on the financial statement, documents claim. ‘When confronted by Nama with this omission Dunne claimed that his name “appeared on the contract to guarantee residency in Switzerland”.’

In a letter to NAMA on Mountbrook Ltd headed notepaper – included as evidence in the Connecticut filings – Dunne denied any ‘beneficial transfer occurred’.

‘In relation to a property in Geneva for historic purposes I wish to advise you… the purchase was completed in August 2008 for a sum of circa CHF4.6m and a mortgage facility of CHF3.5m was raised to finance the purchase. My name appeared on the contract in order to guarantee residency in Switzerland.

‘I did not contribute any equity or pay the mortgage on the property and Mrs Killilea Dunne insisted and I agreed that I be removed from the property documentation effective 23/2/2009 as by then I had obtained residency.

‘I never held an equitable interest in the property as my interest was for the sole purpose of obtaining residency.

‘As I never held an interest in the property we considered the matter when formulating my statement of affairs and concluded it was never an asset and that no beneficial transfer occurred… I do not believe any profit was made on the disposal of the property when property taxes, mortgage repayments and all other related expenses including fitting out costs were taken into consideration. Please note I had no involvement in the sale of the property.’

Sold: The house at 42 Bote Road in Greenwich, Connecticut

Sold: The house at 42 Bote Road in Greenwich, Connecticut

Swiss roll: The property in Geneva

Swiss roll: The property in GenevaIn April 2010, the court documents claim Dunne and Killilea bought 38 Bush Avenue for $2m. They have always denied ownership.

It was bought under the name of Phillip Teplen, a New York immigration lawyer who would later be sued by Killilea over claims he took $500,000 she gave him to hold in escrow to use for property development in the US.

Details of that action, which she won – although it is still unclear how much money she managed to get back – are also included in the complaint. Again, Nama believes that money ultimately came from Dunne.

To add to its argument Nama is making extensive use of articles published in the MoS, in particular one from December 2010.

That article, written by Michael O’Farrell and Valerie Hanley and based on reporting by New York correspondent Annette Witheridge, linked Dunne to 38 Bush Avenue.

The owners poured more than $1m into tearing down the house and rebuilding it, much to the annoyance of some of the monied neighbours in the gated community of Belle Haven.

That house was sold last month for $5.5m, grossing a handsome profit for its owners.

The seller is one Thomas Heagney, but NAMA believes Dunne ultimately will profit from the sale.

Agents Sothebys International were told by the sellers not to disclose even the address in sales pitches for the property in an apparent bid to keep details of the sale under wraps.

The MoS article also revealed Dunne and Killilea were renting a house in Greenwhich for $17,000 a month. Court documents confirm they are still living at that house on Field Point Road.

The court documents also refer to a second MoS piece, from early 2001, detailing the purchase and sale of the apartment in Geneva, Switzerland.

In addition to the property transfers, the filings also allege that Dunne had an interest in Mountbrook USA and Molly Blossom, stating: ‘Dunne transferred his membership interest in Mountbrook USA and Molly Blossom to Killilea for no consideration through the ruse of an attempted retroactive modification to the Articles of Incorporation of the entities.’

Dunne had informed NAMA in a letter: ‘In relation to Mountbrook USA. I am not a shareholder of Mountbrook USA and the sole member of same is Mrs Gayle Killilea Dunne.

‘The lawyer who set up the entity Mr Philip Teplen of Teplen & Associates…incorrectly registered the company naming me as principal, however he did so without any instructions written or oral from me and contrary to the instructions I understand he received from Mrs Gayle Killilea Dunne.

‘I do not believe that Mountbrook USA has any property assets.’

However NAMA cite US tax records to show that Mountbrook USA apparently paid real estate property taxes in 2010 of over $20,000.